By David Gross

F5, which has nearly tripled over the last 12 months, will be added to the S&P 500 after the market close December 17th. The stock was up over 5% after hours yesterday on this news, topping $145 a share.

Netflix, Cablevision, and Newfield Exploration will be joining F5 as new members of the index. Office Depot, The New York Times, Eastman Kodak, and King Pharmaceuticals will be moving out.

Showing posts with label FFIV. Show all posts

Showing posts with label FFIV. Show all posts

Friday, December 10, 2010

Friday, December 3, 2010

F5 at a 52-Week High

By David Gross

In spite of a flat to down market today, F5 hit a 52 week high this morning of $141.58, and has nearly tripled over the last 12 months. It's also up over 50% from Goldman's peculiar downgrade of the stock in October. While F5 is a great company that has done an excellent job staying focused on the L4-7 market, the stock is getting ahead of itself.

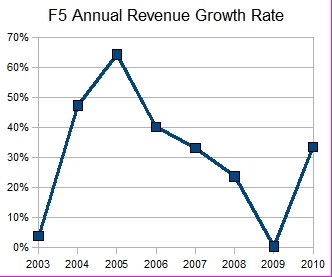

Since 2003, the company's top line has grown 26% annually, but its current y/y growth rate of 45% is near its post dot com crash peak of 47%. It's no secret on Wall Street or in the data center industry that there's a lot of room for both load balancers and WAN Optimization devices to keep growing, but they're not going to keep growing at close to 50% per year, which is what the current enterprise value/earnings ratio of 55 suggests. That said, this is purely a short-term risk, not unlike the spring and summer of 2006 when the stock lost nearly half of its value as its revenue growth rate decelerated from the high 40s into the low 30s. But investors who held on through that volatility are being rewarded now, and anyone planning to benefit from future growth needs to be ready to handle a 2006-like drop with current revenue growth running so far above historical levels.

In spite of a flat to down market today, F5 hit a 52 week high this morning of $141.58, and has nearly tripled over the last 12 months. It's also up over 50% from Goldman's peculiar downgrade of the stock in October. While F5 is a great company that has done an excellent job staying focused on the L4-7 market, the stock is getting ahead of itself.

Since 2003, the company's top line has grown 26% annually, but its current y/y growth rate of 45% is near its post dot com crash peak of 47%. It's no secret on Wall Street or in the data center industry that there's a lot of room for both load balancers and WAN Optimization devices to keep growing, but they're not going to keep growing at close to 50% per year, which is what the current enterprise value/earnings ratio of 55 suggests. That said, this is purely a short-term risk, not unlike the spring and summer of 2006 when the stock lost nearly half of its value as its revenue growth rate decelerated from the high 40s into the low 30s. But investors who held on through that volatility are being rewarded now, and anyone planning to benefit from future growth needs to be ready to handle a 2006-like drop with current revenue growth running so far above historical levels.

Labels:

FFIV,

Layer 4-7 Hardware

Sunday, November 7, 2010

F5 to Present This Week at Wells Fargo and Piper Jaffray Conferences

By David Gross

F5 is presenting at Tuesday's Wells Fargo Conference, and Wednesday's Piper Jaffray Conference. The webcasts from the events will be available at the F5 IR website.

Additionally, the company announced it will be holding an analyst & investor day next Tuesday, the 16th, in New York. Registration and more information on that event is also available on the F5 IR website.

F5 is presenting at Tuesday's Wells Fargo Conference, and Wednesday's Piper Jaffray Conference. The webcasts from the events will be available at the F5 IR website.

Additionally, the company announced it will be holding an analyst & investor day next Tuesday, the 16th, in New York. Registration and more information on that event is also available on the F5 IR website.

Labels:

FFIV,

Layer 4-7 Hardware

Tuesday, October 26, 2010

Equinix Expectations Multiple Coming in Around 17%

By David Gross

The expectations multiple is at work again this afternoon, with Equinix shooting up 7% to over $82 after hours after revenue came in 4/10th of one percent over the midpoint of the guidance range it gave three weeks ago. So it lost over a third of its value after guiding down 2%, and has gotten 7% back after coming .4% higher, an expectations multiple of around 17 in each case.

Separately, F5 Networks is up 3% after hours after reporting revenue of $254 million, or 4% higher than the guidance midpoint of $244.5 million. While this is an expectations multiple of just .75, F5 has rallied 17% over the last week, boosted by Riverbed's stronger-than-expected report.

Either way, this is simply manic buying and panic selling in action. In addition to Equinix and F5, it's happened over the last few months with Mellanox, Riverbed, and PLX Technologies. Wall Street is simply not able to handle the fundamentals of the data center industry calmly.

The expectations multiple is at work again this afternoon, with Equinix shooting up 7% to over $82 after hours after revenue came in 4/10th of one percent over the midpoint of the guidance range it gave three weeks ago. So it lost over a third of its value after guiding down 2%, and has gotten 7% back after coming .4% higher, an expectations multiple of around 17 in each case.

Separately, F5 Networks is up 3% after hours after reporting revenue of $254 million, or 4% higher than the guidance midpoint of $244.5 million. While this is an expectations multiple of just .75, F5 has rallied 17% over the last week, boosted by Riverbed's stronger-than-expected report.

Either way, this is simply manic buying and panic selling in action. In addition to Equinix and F5, it's happened over the last few months with Mellanox, Riverbed, and PLX Technologies. Wall Street is simply not able to handle the fundamentals of the data center industry calmly.

Monday, October 25, 2010

F5 Earnings Preview

By David Gross

F5 reports Tuesday after the close, following a quarter when its stock soared more than 50% to $103 a share, while settling back recently to just over $98 a share. Many of its peers in the layer 4-7 networking market also saw their share prices rise dramatically between July and September, and have followed it up by posting better-than-expected top line growth. Riverbed, for example, was up 65% in the third quarter, and then reported revenue 8% ahead of expectations, and lifted guidance for the December quarter 5%. That stock is now up 100% from where it was July 1st. Citrix saw its value increase 61% in the third quarter, and then reported that its data center revenue grew 47% year-over-year. Moreover, in the slides accompanying its earnings call, Citrix explicitly mentioned that its NetScaler MPX was leading the way in its data center growth, and that product line that competes directly against F5's BIG-IP and VIPRION platforms.

F5 traded up 6% Friday off of Riverbed's better-than-expected earnings report. Additionally, Citrix is its leading competitor, putting additional pressure on the company to outperform. During its last call, F5 gave a top line guidance range of $242 million - $247 million for this quarter, ahead of estimates that were around $230 million. Whisper numbers are pushing $260 million now, and it would likely be a huge disappointment if the company did not lift guidance for next year.

Another factor to look out for is the expectations multiple. Wall Street has largely been overreacting to good and bad news in the heavily watched data center services and networking industries. On its July call, Mellanox announced sequential revenue would decline 7%, and its stock fell more than 30% the next day. On its infamous October 5 warning call, Equinix announced revenue would fall 2% short of guidance, and its stock fell more than 30% the next day. Then last week, Riverbed beat revenue estimates by 8%, and its stock was up more than 18%. The sell-side analysts then started firing out downgrades and upgrades after all these numbers were posted.

It Wall Street-speak, you could say F5 is currently "priced to perfection", especially with the stock getting a 6% bounce of its own off of the Riverbed report. And for years, some have predicted that F5's custom ASICs would eventually lose their lead over the Intel Xeons and merchant silicon used by Netscaler. However, that is not a trend that is going to shift because one quarter's revenue is $5 million higher or lower than expected.

F5 reports Tuesday after the close, following a quarter when its stock soared more than 50% to $103 a share, while settling back recently to just over $98 a share. Many of its peers in the layer 4-7 networking market also saw their share prices rise dramatically between July and September, and have followed it up by posting better-than-expected top line growth. Riverbed, for example, was up 65% in the third quarter, and then reported revenue 8% ahead of expectations, and lifted guidance for the December quarter 5%. That stock is now up 100% from where it was July 1st. Citrix saw its value increase 61% in the third quarter, and then reported that its data center revenue grew 47% year-over-year. Moreover, in the slides accompanying its earnings call, Citrix explicitly mentioned that its NetScaler MPX was leading the way in its data center growth, and that product line that competes directly against F5's BIG-IP and VIPRION platforms.

F5 traded up 6% Friday off of Riverbed's better-than-expected earnings report. Additionally, Citrix is its leading competitor, putting additional pressure on the company to outperform. During its last call, F5 gave a top line guidance range of $242 million - $247 million for this quarter, ahead of estimates that were around $230 million. Whisper numbers are pushing $260 million now, and it would likely be a huge disappointment if the company did not lift guidance for next year.

Another factor to look out for is the expectations multiple. Wall Street has largely been overreacting to good and bad news in the heavily watched data center services and networking industries. On its July call, Mellanox announced sequential revenue would decline 7%, and its stock fell more than 30% the next day. On its infamous October 5 warning call, Equinix announced revenue would fall 2% short of guidance, and its stock fell more than 30% the next day. Then last week, Riverbed beat revenue estimates by 8%, and its stock was up more than 18%. The sell-side analysts then started firing out downgrades and upgrades after all these numbers were posted.

It Wall Street-speak, you could say F5 is currently "priced to perfection", especially with the stock getting a 6% bounce of its own off of the Riverbed report. And for years, some have predicted that F5's custom ASICs would eventually lose their lead over the Intel Xeons and merchant silicon used by Netscaler. However, that is not a trend that is going to shift because one quarter's revenue is $5 million higher or lower than expected.

Labels:

FFIV,

Layer 4-7 Hardware

Sunday, October 24, 2010

Citrix Data Center Revenue Up 47%, Led by Netscaler

By David Gross

The expectations for F5's quarterly earnings report this Tuesday got a big boost from Riverbed beating expectations on its call Wednesday, and were lifted further with Citrix reporting that its data center revenue grew 47% year-over-year to $84 million, led by its Netscaler load balancer. Sales of the software-based Netscaler VPX were up 40% sequentially.

Citrix got into the load balancing business in 2005, when it acquired Netscaler for $300 million. The product line brings a sharp contrast to F5, which is still the market leader, in that Netscaler has been built around merchant silicon, including Intel Xeon processors, while F5 has invested significantly in developing its own ASICs. Nonetheless, with tie-ins to the company's XenServer hypervisor, Citrix has vaulted into the number two spot in the load balancer market, although it still trails F5 nearly two-to-one.

In total, Citrix's revenue was up 18% year-over-year to $472 million, with guidance for next quarter of $500-$510 million. But just as we saw with Juniper and VMWare, the company expanded margins by increasing revenue at a much faster rate than operating expenses. Sales and marketing costs increased at less than a quarter of the pace of the revenue gain, moving up just 4%. However, R&D costs rose 27%, but total operating costs still rose just 11%, allowing operating margins to improve from 14% to 17%. Like Juniper, Citrix has been hiring more engineers while keeping marketing and finance headcount fairly flat. But for Citrix, this is a noteworthy achievement, because Layer 4-7 switching generally requires much greater support than L2-3 switching and routing.

The company generated $190 million of cash from operations, with its cash balance now sitting at $1.59 billion, up from $1.2 billion at the beginning of the year. With an $11.4 market cap, it now has an EV/Revenue ratio of 5.5, which is not cheap, but investors can't overlook Citrix's ability to grow its revenue faster than its headcount.

The expectations for F5's quarterly earnings report this Tuesday got a big boost from Riverbed beating expectations on its call Wednesday, and were lifted further with Citrix reporting that its data center revenue grew 47% year-over-year to $84 million, led by its Netscaler load balancer. Sales of the software-based Netscaler VPX were up 40% sequentially.

Citrix got into the load balancing business in 2005, when it acquired Netscaler for $300 million. The product line brings a sharp contrast to F5, which is still the market leader, in that Netscaler has been built around merchant silicon, including Intel Xeon processors, while F5 has invested significantly in developing its own ASICs. Nonetheless, with tie-ins to the company's XenServer hypervisor, Citrix has vaulted into the number two spot in the load balancer market, although it still trails F5 nearly two-to-one.

In total, Citrix's revenue was up 18% year-over-year to $472 million, with guidance for next quarter of $500-$510 million. But just as we saw with Juniper and VMWare, the company expanded margins by increasing revenue at a much faster rate than operating expenses. Sales and marketing costs increased at less than a quarter of the pace of the revenue gain, moving up just 4%. However, R&D costs rose 27%, but total operating costs still rose just 11%, allowing operating margins to improve from 14% to 17%. Like Juniper, Citrix has been hiring more engineers while keeping marketing and finance headcount fairly flat. But for Citrix, this is a noteworthy achievement, because Layer 4-7 switching generally requires much greater support than L2-3 switching and routing.

The company generated $190 million of cash from operations, with its cash balance now sitting at $1.59 billion, up from $1.2 billion at the beginning of the year. With an $11.4 market cap, it now has an EV/Revenue ratio of 5.5, which is not cheap, but investors can't overlook Citrix's ability to grow its revenue faster than its headcount.

Labels:

CTXS,

FFIV,

Layer 4-7 Hardware

Friday, October 8, 2010

Goldman's F5 Downgrade Makes No Sense

By David Gross

Read tidbits of the Goldman note on F5 (FFIV) this morning where they downgraded the stock to "sell", but very little of it made any sense.

On top line growth, the analyst said "85% of the company's growth comes from server refresh and share gains, rather than cloud build-outs".

First problem is that there is no such thing as "cloud build-out". Cloud is a buzzword that means different things to different people, and until someone like Rackspace (RAX) or Terremark (TMRK) actually starts getting a third of their revenue from a cloud services, I won't be able to say it with a straight face. The problem with using it like Goldman does is that it distorts what customers actually do with load balancers. F5 customers are generally thinking about issues like DNS Round Robin, content caching, and cookie-based switching, not "clouds". Even in the buzzword-crazy 90s, we didn't say cloud networking, we called it Frame Relay. At least call it shared computing and narrow down what you're actually referring to, and don't even begin to think there is such a thing as a "cloud" stock.

"Server refresh" is another meaningless catch phrase. Moreover, there has been little correlation historically between revenue growth in servers and revenue growth in load balancers. F5 had decelerating growth in 2007 before the recession, and when servers were flying off the shelves at IBM and Dell. Might make sense logically, but there is no data to support a link between server shipments and load balancer, excuse me, application delivery controller, shipments. Perhaps things would be clearer if vendors and analysts alike stopped using so many ridiculous product names and buzzwords that have little connection to actual product uses.

Regarding share gains, F5's biggest came between 2001 and 2005 when Foundry decided to emphasize Ethernet switches, and let its formerly market-leading ServerIron get crushed by F5's BIG-IP. Cisco (CSCO) has never been dominant in this sector, and I don't think they're looking at that Arrowpoint deal so fondly anymore. Still, unlike most other markets where they're not #1 or #2, Cisco won't admit defeat in layer 4-7 products, which extends to the TCP/WAN Acceleration market where their WAAS module has trailed Riverbed (RVBD) badly for over three years. In F5's case, share gain has been far less of a contributor to growth than it was years ago.

I can understand someone suggesting that F5 is overvalued at 7x its revenue run rate. But its growth has never been linear, has never been tied to "server refreshes", is not tied to any catchy buzzwords, and the company still owes its market leading position today to misguided decisions Foundry made nearly ten years ago.

Read tidbits of the Goldman note on F5 (FFIV) this morning where they downgraded the stock to "sell", but very little of it made any sense.

On top line growth, the analyst said "85% of the company's growth comes from server refresh and share gains, rather than cloud build-outs".

First problem is that there is no such thing as "cloud build-out". Cloud is a buzzword that means different things to different people, and until someone like Rackspace (RAX) or Terremark (TMRK) actually starts getting a third of their revenue from a cloud services, I won't be able to say it with a straight face. The problem with using it like Goldman does is that it distorts what customers actually do with load balancers. F5 customers are generally thinking about issues like DNS Round Robin, content caching, and cookie-based switching, not "clouds". Even in the buzzword-crazy 90s, we didn't say cloud networking, we called it Frame Relay. At least call it shared computing and narrow down what you're actually referring to, and don't even begin to think there is such a thing as a "cloud" stock.

"Server refresh" is another meaningless catch phrase. Moreover, there has been little correlation historically between revenue growth in servers and revenue growth in load balancers. F5 had decelerating growth in 2007 before the recession, and when servers were flying off the shelves at IBM and Dell. Might make sense logically, but there is no data to support a link between server shipments and load balancer, excuse me, application delivery controller, shipments. Perhaps things would be clearer if vendors and analysts alike stopped using so many ridiculous product names and buzzwords that have little connection to actual product uses.

Regarding share gains, F5's biggest came between 2001 and 2005 when Foundry decided to emphasize Ethernet switches, and let its formerly market-leading ServerIron get crushed by F5's BIG-IP. Cisco (CSCO) has never been dominant in this sector, and I don't think they're looking at that Arrowpoint deal so fondly anymore. Still, unlike most other markets where they're not #1 or #2, Cisco won't admit defeat in layer 4-7 products, which extends to the TCP/WAN Acceleration market where their WAAS module has trailed Riverbed (RVBD) badly for over three years. In F5's case, share gain has been far less of a contributor to growth than it was years ago.

I can understand someone suggesting that F5 is overvalued at 7x its revenue run rate. But its growth has never been linear, has never been tied to "server refreshes", is not tied to any catchy buzzwords, and the company still owes its market leading position today to misguided decisions Foundry made nearly ten years ago.

Thursday, October 7, 2010

Volatile Data Center Stocks are Good for Data Center Businesses

By David Gross

As it was losing nearly a third of its value yesterday, Equinix (EQIX) saw 30 million of its shares change hands, representing nearly 70% of its float, and 40 times its normal volume. 3.1 million of these shares traded on Direct Edge, whose primary data center is Equinix's NY4, which is just across the Hudson from Wall Street in Secaucus. Many investors are familiar with retail analysts who walk around malls to see how busy the stores are. What if those investors could see where their Equinix trades were being executed?

Now it's not clear why Citrix (CTXS) should have dropped 14% because Equinix guided revenue down by 2%, but in the selling panic, nearly 18 million shares of Citrix stock traded hands. Normally 3 million do. F5 (FFIV) saw 7.6 million shares move compared to 1.6 million on a typical day. Savvis (SVVS), which reaffirmed guidance for a quarter that's already ended, lost 10% of its value, and saw 5 million shares trade hands vs. 320,000 on an average day. And with all the noise out there still ringing in your ears about a co-lo company starting with "E", I won't mention their name again in this post.

There were some days last quarter when these stocks were being bid up for no good reason where they did 2-4x normal volumes. Savvis, for example, saw nearly 600,000 shares move on September 24th when it was up over a dollar. F5 traded 5.5 million shares on July 22nd when it was up nearly 15% for the day. Citrix was up nearly 20% on July 29th when 14 million shares of the company traded.

These sharp moves - up and down - reflect a manic psychology in many of these names, which is not uncommon for a sector that's getting a lot of attention. But the financial strength of many data center providers depends on financial trades. Savvis, for example, gets nearly 30% of its revenue from financial services, much of which is trades and market data to support those trades. So data centers should continue to do well as long as investors keep having selling panics, irrational love affairs with certain stocks, and keep building more algos. A wave of rational buy-and-hold investors is the last thing this industry needs.

As it was losing nearly a third of its value yesterday, Equinix (EQIX) saw 30 million of its shares change hands, representing nearly 70% of its float, and 40 times its normal volume. 3.1 million of these shares traded on Direct Edge, whose primary data center is Equinix's NY4, which is just across the Hudson from Wall Street in Secaucus. Many investors are familiar with retail analysts who walk around malls to see how busy the stores are. What if those investors could see where their Equinix trades were being executed?

Now it's not clear why Citrix (CTXS) should have dropped 14% because Equinix guided revenue down by 2%, but in the selling panic, nearly 18 million shares of Citrix stock traded hands. Normally 3 million do. F5 (FFIV) saw 7.6 million shares move compared to 1.6 million on a typical day. Savvis (SVVS), which reaffirmed guidance for a quarter that's already ended, lost 10% of its value, and saw 5 million shares trade hands vs. 320,000 on an average day. And with all the noise out there still ringing in your ears about a co-lo company starting with "E", I won't mention their name again in this post.

There were some days last quarter when these stocks were being bid up for no good reason where they did 2-4x normal volumes. Savvis, for example, saw nearly 600,000 shares move on September 24th when it was up over a dollar. F5 traded 5.5 million shares on July 22nd when it was up nearly 15% for the day. Citrix was up nearly 20% on July 29th when 14 million shares of the company traded.

These sharp moves - up and down - reflect a manic psychology in many of these names, which is not uncommon for a sector that's getting a lot of attention. But the financial strength of many data center providers depends on financial trades. Savvis, for example, gets nearly 30% of its revenue from financial services, much of which is trades and market data to support those trades. So data centers should continue to do well as long as investors keep having selling panics, irrational love affairs with certain stocks, and keep building more algos. A wave of rational buy-and-hold investors is the last thing this industry needs.

Wednesday, September 29, 2010

Savvis Best Performing Data Center Services Stock This Quarter

With two trading days left in the quarter, Savvis (SVVS) leads data center stocks with a 45.07% gain since July 1, outpacing runner up Rackspace (RAX) by nearly three points. Terremark (TMRK), Equinix (EQIX), and Navisite (NAVI) are all up over 25% for the quarter.

Among data center networkers, F5 (FFIV) leads the pack, up 51% for the quarter, well ahead of the 2.58% gain posted by Cisco (CSCO). If you include companies whose products connect data center to data centers, Riverbed (RVBD) leads everyone, up over 66% for the quarter.

Among data center networkers, F5 (FFIV) leads the pack, up 51% for the quarter, well ahead of the 2.58% gain posted by Cisco (CSCO). If you include companies whose products connect data center to data centers, Riverbed (RVBD) leads everyone, up over 66% for the quarter.

Wednesday, September 8, 2010

Is it Time to Sell F5?

by David Gross

Few stocks have performed like F5 (FFIV) over the last year. It's risen over 150% the last 12 months, while NASDAQ has eeked out a 9% gain, and rival Cisco (CSCO) has fallen 5%. Its other chief competitor, Citrix (CTXS), has risen just 71%, less than half as much as F5, renewing calls that the stock is overvalued, and ready for a fall.

F5's rise over the last few years has climbed a wall of worry. When it hit $26 in April 2009, UBS downgraded it citing valuation concerns. Since then, the stock has risen more than three-fold. Moreover, the fundamentals have remained very strong, with top line growth exceeding 40%, the cash balance growing and nearing $900 million, negligible long-term debt, a workforce that produces nearly 50% more revenue per head than rival Citrix, and Cisco (CSCO) still struggling to find its way in the load balancing market.

Between 2000 and 2003, F5's annual revenue was essentially flat, bouncing around between $108 million and $116 million. Since then, it's grown eight-fold, with last quarter's revenue coming in at $230 million. With the exception of 2009, when it grew just 0.5% due to the recession, the company's top line growth has come in anywhere between 24% and 64% since 2004. If it hits its guidance in its fiscal 4th quarter for 2010, which ends this month, it will report 34% growth for 2010.

From 2005 and 2007, the company's growth rate was nearly cut in half, from 64% to 33%, before the recession began. While many are expecting lower growth in 2011, Wall Street hasn't treated the stock well when its growth rate has slowed. From August 2007 to March 2008, when growth was decelerating, but still over 20% year-over-year, the stock lost 58% of its value, a period during which NASDAQ fell just 15%.

The current enterprise value/annualized earnings ratio of 41 is certainly high, but nothing like its obscene late 1999 valuation when the company was 96% smaller than it is now, generated nearly a quarter of its revenue from a soon-to-be-bankrupt Exodus, but had a market cap just 20% lower than today's soaring value. Moreover, many of the product lines it competed against then, such as Cisco/ArrowPoint, Nortel/Alteon/Radware, and Foundry/Brocade, are the same, yet have struggled amid mergers, acquisitions, and management focus on other product categories. So while the long term story for F5 continues to look very good, the sudden price drops that have accompanied its periods of slowing growth should make investors think twice before getting in at these levels.

Few stocks have performed like F5 (FFIV) over the last year. It's risen over 150% the last 12 months, while NASDAQ has eeked out a 9% gain, and rival Cisco (CSCO) has fallen 5%. Its other chief competitor, Citrix (CTXS), has risen just 71%, less than half as much as F5, renewing calls that the stock is overvalued, and ready for a fall.

F5's rise over the last few years has climbed a wall of worry. When it hit $26 in April 2009, UBS downgraded it citing valuation concerns. Since then, the stock has risen more than three-fold. Moreover, the fundamentals have remained very strong, with top line growth exceeding 40%, the cash balance growing and nearing $900 million, negligible long-term debt, a workforce that produces nearly 50% more revenue per head than rival Citrix, and Cisco (CSCO) still struggling to find its way in the load balancing market.

Between 2000 and 2003, F5's annual revenue was essentially flat, bouncing around between $108 million and $116 million. Since then, it's grown eight-fold, with last quarter's revenue coming in at $230 million. With the exception of 2009, when it grew just 0.5% due to the recession, the company's top line growth has come in anywhere between 24% and 64% since 2004. If it hits its guidance in its fiscal 4th quarter for 2010, which ends this month, it will report 34% growth for 2010.

From 2005 and 2007, the company's growth rate was nearly cut in half, from 64% to 33%, before the recession began. While many are expecting lower growth in 2011, Wall Street hasn't treated the stock well when its growth rate has slowed. From August 2007 to March 2008, when growth was decelerating, but still over 20% year-over-year, the stock lost 58% of its value, a period during which NASDAQ fell just 15%.

The current enterprise value/annualized earnings ratio of 41 is certainly high, but nothing like its obscene late 1999 valuation when the company was 96% smaller than it is now, generated nearly a quarter of its revenue from a soon-to-be-bankrupt Exodus, but had a market cap just 20% lower than today's soaring value. Moreover, many of the product lines it competed against then, such as Cisco/ArrowPoint, Nortel/Alteon/Radware, and Foundry/Brocade, are the same, yet have struggled amid mergers, acquisitions, and management focus on other product categories. So while the long term story for F5 continues to look very good, the sudden price drops that have accompanied its periods of slowing growth should make investors think twice before getting in at these levels.

Labels:

FFIV,

Layer 4-7 Hardware

Monday, August 2, 2010

Revenue Growth Slowing for Data Center Technologists

While data centers continue to defy the economy, revenue growth is clearly slowing down for the technology suppliers. Sequential rates have been much lower on an annualized basis than Year-over-Year growth rates, and the 2nd quarter typically gets a rebound off the 1st quarter lull. Mellanox (MLNX) reported strong sequential growth, but guided down for the next quarter, and VMWare (VMW), which is majority owned by EMC (EMC) stated that license revenue would be flat.

I'll have another post with the service providers after Rackspace (RAX) reports, but the trend looks similar there - with growth continuing, but at a slowing pace.

Y/Y Rev Growth Sequential Sequential

Rev Growth Rev Growth Inventory Growth

MLNX 58% 10% -3%

VOLT 54% 7% -14%

QLGC 16% -2% 26%

FFIV 46% 12% 8%

EMC 24% 3% -4%

I'll have another post with the service providers after Rackspace (RAX) reports, but the trend looks similar there - with growth continuing, but at a slowing pace.

Y/Y Rev Growth Sequential Sequential

Rev Growth Rev Growth Inventory Growth

MLNX 58% 10% -3%

VOLT 54% 7% -14%

QLGC 16% -2% 26%

FFIV 46% 12% 8%

EMC 24% 3% -4%

Wednesday, July 28, 2010

F5's Market Cap Surpasses Alcatel-Lucent's

The price spike after F5's (FFIV) earnings call last week pushed its market cap over $6.5 billion, surpassing industry stalwart Alcatel-Lucent (ALU), which was at $6.2 billion after yesterday's close. This is an absolutely remarkable development for the networking industry, and shows how important it is to stay focused on industry sub-segments where you're either #1 or #2.

If you think of some of the highest revenue product categories in networking, from core routing to Ethernet switching to 4G wireless, Alcatel-Lucent is in every one of them, while F5 is none of them. So why is its market cap higher?

F5's valuation is a little rich, but certainly not wildly out of control in a 1999 sort of way. It has $780 million of cash and investments, no long-term debt, $40.5 million in net income last quarter, and a $6.9 billion market cap as of yesterday's close. Net of cash this gives the stock a P/E of 38 on annualized earnings, which is lower than its 46% top line growth rate over the last 12 months, and its nearly 90% bottom line growth for the last year.

Excessive optimism is not really the cause of F5 leaping past Alcatel-Lucent, but tremendous focus is. The company does not have an offering in any of the major networking categories, but it is a leader in a growing niche. Alcatel-Lucent, on the other hand, participates in just about every major segment, but leads very few. And its financial reflect this. Its gross margins have been hanging around the low 30s, while F5's have been pushing 80%. While many of the telecom products Alcatel-Lucent offers sell for lower gross margins due to high raw materials costs, Infinera (INFN), which is focused entirely on the low gross margin optical sector, is now posting higher gross margins than Alcatel-Lucent.

Still Recovering from McGinn-Russo

The current challenges at Alcatel-Lucent really have little to do with current management, and in fairness to the new executive team, they have been very focused on reducing overheads and trimming expenses in spite of stereotypes about bloated French bureaucracies. The company's SG&A/Revenue ratio is down to 21%, lower than many of the smaller vendors. Moreover, just 12% of the company's workforce is in France.

Alcatel-Lucent's challenge is the incredibly diverse set of products it must manage, which in part reflects the wild acquisition and over-diversification of the McGinn-Russo era at Lucent, as well as the old school approach of being a supplier who does everything for its telecom customers. This is one reason why its gross margins are low, it has long inventory cycles and must support production and development across a wide range of data, optical, and wireless products. F5, on the other hand, has never tried to have a high "share of wallet", because much of its customers' equipment spending goes to routers and Ethernet switches, neither of which are in its product catalog.

Ten years ago, it was said that startups had no shot at competing against large suppliers like Lucent, Nortel, and Alcatel at major carriers. While this was factually true, it concealed the fact that there was little economic value to being a diversified telco supplier. Even Cisco (CSCO) struggled to break into the carrier market, and scaled back its optical ambitions when its killed its optical switch acquired through Monterrey, and it never even tried to get into 3G or 4G wireless.

Alcatel-Lucent still leads some product categories, notably DSL and Fiber-to-the-Home. Nonetheless, it still needs to trim down its offerings if it wants its market cap to catch up with those vendors generating higher gross margins by offering fewer products.

If you think of some of the highest revenue product categories in networking, from core routing to Ethernet switching to 4G wireless, Alcatel-Lucent is in every one of them, while F5 is none of them. So why is its market cap higher?

F5's valuation is a little rich, but certainly not wildly out of control in a 1999 sort of way. It has $780 million of cash and investments, no long-term debt, $40.5 million in net income last quarter, and a $6.9 billion market cap as of yesterday's close. Net of cash this gives the stock a P/E of 38 on annualized earnings, which is lower than its 46% top line growth rate over the last 12 months, and its nearly 90% bottom line growth for the last year.

Excessive optimism is not really the cause of F5 leaping past Alcatel-Lucent, but tremendous focus is. The company does not have an offering in any of the major networking categories, but it is a leader in a growing niche. Alcatel-Lucent, on the other hand, participates in just about every major segment, but leads very few. And its financial reflect this. Its gross margins have been hanging around the low 30s, while F5's have been pushing 80%. While many of the telecom products Alcatel-Lucent offers sell for lower gross margins due to high raw materials costs, Infinera (INFN), which is focused entirely on the low gross margin optical sector, is now posting higher gross margins than Alcatel-Lucent.

Still Recovering from McGinn-Russo

The current challenges at Alcatel-Lucent really have little to do with current management, and in fairness to the new executive team, they have been very focused on reducing overheads and trimming expenses in spite of stereotypes about bloated French bureaucracies. The company's SG&A/Revenue ratio is down to 21%, lower than many of the smaller vendors. Moreover, just 12% of the company's workforce is in France.

Alcatel-Lucent's challenge is the incredibly diverse set of products it must manage, which in part reflects the wild acquisition and over-diversification of the McGinn-Russo era at Lucent, as well as the old school approach of being a supplier who does everything for its telecom customers. This is one reason why its gross margins are low, it has long inventory cycles and must support production and development across a wide range of data, optical, and wireless products. F5, on the other hand, has never tried to have a high "share of wallet", because much of its customers' equipment spending goes to routers and Ethernet switches, neither of which are in its product catalog.

Ten years ago, it was said that startups had no shot at competing against large suppliers like Lucent, Nortel, and Alcatel at major carriers. While this was factually true, it concealed the fact that there was little economic value to being a diversified telco supplier. Even Cisco (CSCO) struggled to break into the carrier market, and scaled back its optical ambitions when its killed its optical switch acquired through Monterrey, and it never even tried to get into 3G or 4G wireless.

Alcatel-Lucent still leads some product categories, notably DSL and Fiber-to-the-Home. Nonetheless, it still needs to trim down its offerings if it wants its market cap to catch up with those vendors generating higher gross margins by offering fewer products.

Friday, July 23, 2010

Does Mellanox Know How it Will Grow?

by David Gross

This week, Mellanox (MLNX) joined the list of data center hardware suppliers reporting double digit year-over-year revenue growth. Its top line grew 58% annually to $40 million this past quarter. However, unlike F5 Networks (FFIV) and EMC (EMC), which both guided up for their next reporting periods, Mellanox announced that it expected revenue to decline about 7% sequentially in the third quarter. While it claimed things should turn around in the 4th quarter, the stock was down 25% soon after the announcement.

The company claims that the reason for the temporary decline is a product shift to silicon and away from boards and host channel adapters. This represents a sharp reversal of the trend it saw for much of 2009, when adapter revenue grew while silicon revenue dropped. Given the timing of its 40/100 Gigabit and LAN-on-Motherboard product cycles, this trend could keep going back and forth in the future, which has a big impact on revenue because individual adapters sell for roughly ten times the price of individual semiconductors.

While investors reacted swiftly to the revenue announcement, a bigger concern is not the shifting revenue among product components, but the company's apparent lack of faith in the InfiniBand market is dominates. InfiniBand is a growing, high-end, niche technology. Among the world's 500 largest supercomputers, 42% use InfiniBand as their interconnect between server nodes. Two years ago, only 24% did, according to Top500.org. But InfiniBand's success in supercomputing has yet to translate into major wins in traditional data centers, where it runs into the mass of existing Ethernet switches.

The company's response, developed in conjunction with the InfiniBand Trade Association it is heavily involved with, has been to develop RDMA over Converged Ethernet, or RoCE, pronounced liked the character Sylvester Stallone played in the 70s and 80s. In many respects, RoCE is InfiniBand-over-Ethernet, it uses InfiniBand networking technologies, but slides them into Ethernet frames. Traditionally, pricing for one link technology over another has not been competitive, because low volume multi-protocol boards require more silicon and design work than single protocol equivalents. This has been seen in the more widely promoted Fibre Channel-over-Ethernet, where Converged Network Adapters based on that technology are still selling for about three times the price of standard 10 Gigabit Ethernet server NICs.

By investing in RoCE, Mellanox is basically saying InfiniBand will not be able to stimulate demand on its own in the data center, even though it offers remarkable price/performance in supercomputing clusters. Moreover, there is still plenty of opportunity for InfiniBand to have an impact as IT mangers begin to look at 40 Gigabit alternatives. But just as the company cannot seem to figure out if growth will come for adapter cards or silicon, its now going against its push for RoCE by touting a Google engineering presentation that highlighted the benefits of running pure InfiniBand in a data center network.

Mellanox has long been a high margin company with a dominant position in a niche technology, and its strong balance sheet reflects this heritage. And the stock's recent pummeling has sent the company's valuation down to just 2.5 times cash. But by sending out so many conflicting messages about chips vs. cards and InfiniBand vs. Ethernet, the question is not whether investors have confidence in the company's growth plans, but whether management does.

This week, Mellanox (MLNX) joined the list of data center hardware suppliers reporting double digit year-over-year revenue growth. Its top line grew 58% annually to $40 million this past quarter. However, unlike F5 Networks (FFIV) and EMC (EMC), which both guided up for their next reporting periods, Mellanox announced that it expected revenue to decline about 7% sequentially in the third quarter. While it claimed things should turn around in the 4th quarter, the stock was down 25% soon after the announcement.

The company claims that the reason for the temporary decline is a product shift to silicon and away from boards and host channel adapters. This represents a sharp reversal of the trend it saw for much of 2009, when adapter revenue grew while silicon revenue dropped. Given the timing of its 40/100 Gigabit and LAN-on-Motherboard product cycles, this trend could keep going back and forth in the future, which has a big impact on revenue because individual adapters sell for roughly ten times the price of individual semiconductors.

While investors reacted swiftly to the revenue announcement, a bigger concern is not the shifting revenue among product components, but the company's apparent lack of faith in the InfiniBand market is dominates. InfiniBand is a growing, high-end, niche technology. Among the world's 500 largest supercomputers, 42% use InfiniBand as their interconnect between server nodes. Two years ago, only 24% did, according to Top500.org. But InfiniBand's success in supercomputing has yet to translate into major wins in traditional data centers, where it runs into the mass of existing Ethernet switches.

The company's response, developed in conjunction with the InfiniBand Trade Association it is heavily involved with, has been to develop RDMA over Converged Ethernet, or RoCE, pronounced liked the character Sylvester Stallone played in the 70s and 80s. In many respects, RoCE is InfiniBand-over-Ethernet, it uses InfiniBand networking technologies, but slides them into Ethernet frames. Traditionally, pricing for one link technology over another has not been competitive, because low volume multi-protocol boards require more silicon and design work than single protocol equivalents. This has been seen in the more widely promoted Fibre Channel-over-Ethernet, where Converged Network Adapters based on that technology are still selling for about three times the price of standard 10 Gigabit Ethernet server NICs.

By investing in RoCE, Mellanox is basically saying InfiniBand will not be able to stimulate demand on its own in the data center, even though it offers remarkable price/performance in supercomputing clusters. Moreover, there is still plenty of opportunity for InfiniBand to have an impact as IT mangers begin to look at 40 Gigabit alternatives. But just as the company cannot seem to figure out if growth will come for adapter cards or silicon, its now going against its push for RoCE by touting a Google engineering presentation that highlighted the benefits of running pure InfiniBand in a data center network.

Mellanox has long been a high margin company with a dominant position in a niche technology, and its strong balance sheet reflects this heritage. And the stock's recent pummeling has sent the company's valuation down to just 2.5 times cash. But by sending out so many conflicting messages about chips vs. cards and InfiniBand vs. Ethernet, the question is not whether investors have confidence in the company's growth plans, but whether management does.

Labels:

EMC,

FFIV,

InfiniBand,

MLNX

Wednesday, July 21, 2010

Mellanox Revenue up 58% year-over year, F5 up 46% UPDATED

Mellanox (MLNX) and F5 (FFIV), both dependent on data centers and HPC both reported strong revenue growth today, with Mellanox's top line up 10% sequentially and 58% year-over-year, and F5 up 12% sequential and 46% y/y. But the similarities end there. Mellanox guided for a 7% revenue decline next quarter due to product mix, while F5 guided up, 5% past current estimates. After hours trading reflected these two very different outlooks for the upcoming quarter.

Mellanox blamed a shift in product mix from boards to chips, as it ramps up volumes of its silicon for LAN-on-Motherboard cards, which sell for far less than its InfiniBand HCAs. Still, InfiniBand's share of Top500 Supercomputing interconnects is rising, from 30% in June 2009 to 36% in November 2009 to 42% in June 2010. If this business is all going to QLogic (QLGC), we'll find out tomorrow, when that supplier reports.

Mellanox blamed a shift in product mix from boards to chips, as it ramps up volumes of its silicon for LAN-on-Motherboard cards, which sell for far less than its InfiniBand HCAs. Still, InfiniBand's share of Top500 Supercomputing interconnects is rising, from 30% in June 2009 to 36% in November 2009 to 42% in June 2010. If this business is all going to QLogic (QLGC), we'll find out tomorrow, when that supplier reports.

Tuesday, July 6, 2010

Equinix, F5, and Akamai - Growing More by Doing Less

by David Gross

I wrote last week that data center revenue continues to grow in spite of the economy. In particular, three companies from different segments of the data center market, Equinix (EQIX), F5 (FFIV), and Akamai (AKAM), have increased their top line over the last 12 months. However, in years past, I remember hearing how they were going to go away.

Equinix has grown 24% year-over-year as its data centers continue to fill up, and its lease rates continue to rise. But I remember in 2000 hearing how Equinix was not going to stick around a long time, because hosting leaders like Exodus, in addition to the telcos, would put it out of business, and that its service line was too thin. Ten years later, Exodus and many of the ISPs who were supposed to put Equinix out of business are now out of business themselves.

The benefits of a tight product focus have extended to the network equipment market, where Cisco (CSCO) did not have a strong presence in layer 4-7 switching market until it bought Arrowpoint at the top of the market in 2000. And I remember in 2000, the load balancer everyone raved about was not Arrowpoint's, or even F5's BIG-IP , but Foundry's ServerIron. The challenge for the ServerIron was not performance, customer acceptance, or market share, but its parent company's focus on the much larger Ethernet switch market. Today, F5 has twice the market cap of the merged Brocade (BRCD) and Foundry company.

As with F5, economic conditions did not prevent Akamai from reporting year-over-year growth of 12% last quarter. But the last recession did not go too well for the content distribution network provider. It lost its founder in the 9/11 attacks. In 2002, its revenue declined, and it posted an operating margin of minus 141%, which led Wall Street to classify it as another low margin telecom transport provider. The consensus thinking was the CDN market was too small to be important, and if it ever got big, a large carrier would come in and take it over. Yet as it recovered in the mid-2000s, Akamai wisely avoided any temptation to over-diversify. Eight years since bottoming out, the company has grown its top line sixfold, and is on the verge of crossing $1 billion in sales. However, much of its financial strength is not reflected in its income statement, but its balance sheet, where unlike virtually every telco, it has very little long-term debt.

Akamai's primary telco competitor is Level 3 (LVLT), which got into the CDN market by buying Savvis' (SVVS) old business, which got into the CDN market itself by acquiring the American assets of my former employer, Cable & Wireless, which got into CDNs by acquiring Digital Island. Level 3 has had some big wins recently, including mlb.com, but in addition to having to support a wide range of telecom services, it is weighed down by a significant debt load.

It is very easy to cave in to Wall Street pressure to boost top line numbers by making questionable R&D choices, or by entering a market where there is little chance of ever being the number one or two supplier. This pressure is often greatest when multiples are high, and executives start scrambling to justify a growing market cap. But by refusing to go on wild revenue chases when times were good, these three companies have increased sales when times have been bad.

I wrote last week that data center revenue continues to grow in spite of the economy. In particular, three companies from different segments of the data center market, Equinix (EQIX), F5 (FFIV), and Akamai (AKAM), have increased their top line over the last 12 months. However, in years past, I remember hearing how they were going to go away.

Equinix has grown 24% year-over-year as its data centers continue to fill up, and its lease rates continue to rise. But I remember in 2000 hearing how Equinix was not going to stick around a long time, because hosting leaders like Exodus, in addition to the telcos, would put it out of business, and that its service line was too thin. Ten years later, Exodus and many of the ISPs who were supposed to put Equinix out of business are now out of business themselves.

The benefits of a tight product focus have extended to the network equipment market, where Cisco (CSCO) did not have a strong presence in layer 4-7 switching market until it bought Arrowpoint at the top of the market in 2000. And I remember in 2000, the load balancer everyone raved about was not Arrowpoint's, or even F5's BIG-IP , but Foundry's ServerIron. The challenge for the ServerIron was not performance, customer acceptance, or market share, but its parent company's focus on the much larger Ethernet switch market. Today, F5 has twice the market cap of the merged Brocade (BRCD) and Foundry company.

As with F5, economic conditions did not prevent Akamai from reporting year-over-year growth of 12% last quarter. But the last recession did not go too well for the content distribution network provider. It lost its founder in the 9/11 attacks. In 2002, its revenue declined, and it posted an operating margin of minus 141%, which led Wall Street to classify it as another low margin telecom transport provider. The consensus thinking was the CDN market was too small to be important, and if it ever got big, a large carrier would come in and take it over. Yet as it recovered in the mid-2000s, Akamai wisely avoided any temptation to over-diversify. Eight years since bottoming out, the company has grown its top line sixfold, and is on the verge of crossing $1 billion in sales. However, much of its financial strength is not reflected in its income statement, but its balance sheet, where unlike virtually every telco, it has very little long-term debt.

Akamai's primary telco competitor is Level 3 (LVLT), which got into the CDN market by buying Savvis' (SVVS) old business, which got into the CDN market itself by acquiring the American assets of my former employer, Cable & Wireless, which got into CDNs by acquiring Digital Island. Level 3 has had some big wins recently, including mlb.com, but in addition to having to support a wide range of telecom services, it is weighed down by a significant debt load.

It is very easy to cave in to Wall Street pressure to boost top line numbers by making questionable R&D choices, or by entering a market where there is little chance of ever being the number one or two supplier. This pressure is often greatest when multiples are high, and executives start scrambling to justify a growing market cap. But by refusing to go on wild revenue chases when times were good, these three companies have increased sales when times have been bad.

Subscribe to:

Posts (Atom)