By David Gross

In spite of a flat to down market today, F5 hit a 52 week high this morning of $141.58, and has nearly tripled over the last 12 months. It's also up over 50% from Goldman's peculiar downgrade of the stock in October. While F5 is a great company that has done an excellent job staying focused on the L4-7 market, the stock is getting ahead of itself.

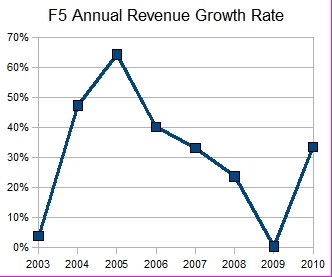

Since 2003, the company's top line has grown 26% annually, but its current y/y growth rate of 45% is near its post dot com crash peak of 47%. It's no secret on Wall Street or in the data center industry that there's a lot of room for both load balancers and WAN Optimization devices to keep growing, but they're not going to keep growing at close to 50% per year, which is what the current enterprise value/earnings ratio of 55 suggests. That said, this is purely a short-term risk, not unlike the spring and summer of 2006 when the stock lost nearly half of its value as its revenue growth rate decelerated from the high 40s into the low 30s. But investors who held on through that volatility are being rewarded now, and anyone planning to benefit from future growth needs to be ready to handle a 2006-like drop with current revenue growth running so far above historical levels.

Showing posts with label Layer 4-7 Hardware. Show all posts

Showing posts with label Layer 4-7 Hardware. Show all posts

Friday, December 3, 2010

Sunday, November 7, 2010

F5 to Present This Week at Wells Fargo and Piper Jaffray Conferences

By David Gross

F5 is presenting at Tuesday's Wells Fargo Conference, and Wednesday's Piper Jaffray Conference. The webcasts from the events will be available at the F5 IR website.

Additionally, the company announced it will be holding an analyst & investor day next Tuesday, the 16th, in New York. Registration and more information on that event is also available on the F5 IR website.

F5 is presenting at Tuesday's Wells Fargo Conference, and Wednesday's Piper Jaffray Conference. The webcasts from the events will be available at the F5 IR website.

Additionally, the company announced it will be holding an analyst & investor day next Tuesday, the 16th, in New York. Registration and more information on that event is also available on the F5 IR website.

Labels:

FFIV,

Layer 4-7 Hardware

Monday, October 25, 2010

F5 Earnings Preview

By David Gross

F5 reports Tuesday after the close, following a quarter when its stock soared more than 50% to $103 a share, while settling back recently to just over $98 a share. Many of its peers in the layer 4-7 networking market also saw their share prices rise dramatically between July and September, and have followed it up by posting better-than-expected top line growth. Riverbed, for example, was up 65% in the third quarter, and then reported revenue 8% ahead of expectations, and lifted guidance for the December quarter 5%. That stock is now up 100% from where it was July 1st. Citrix saw its value increase 61% in the third quarter, and then reported that its data center revenue grew 47% year-over-year. Moreover, in the slides accompanying its earnings call, Citrix explicitly mentioned that its NetScaler MPX was leading the way in its data center growth, and that product line that competes directly against F5's BIG-IP and VIPRION platforms.

F5 traded up 6% Friday off of Riverbed's better-than-expected earnings report. Additionally, Citrix is its leading competitor, putting additional pressure on the company to outperform. During its last call, F5 gave a top line guidance range of $242 million - $247 million for this quarter, ahead of estimates that were around $230 million. Whisper numbers are pushing $260 million now, and it would likely be a huge disappointment if the company did not lift guidance for next year.

Another factor to look out for is the expectations multiple. Wall Street has largely been overreacting to good and bad news in the heavily watched data center services and networking industries. On its July call, Mellanox announced sequential revenue would decline 7%, and its stock fell more than 30% the next day. On its infamous October 5 warning call, Equinix announced revenue would fall 2% short of guidance, and its stock fell more than 30% the next day. Then last week, Riverbed beat revenue estimates by 8%, and its stock was up more than 18%. The sell-side analysts then started firing out downgrades and upgrades after all these numbers were posted.

It Wall Street-speak, you could say F5 is currently "priced to perfection", especially with the stock getting a 6% bounce of its own off of the Riverbed report. And for years, some have predicted that F5's custom ASICs would eventually lose their lead over the Intel Xeons and merchant silicon used by Netscaler. However, that is not a trend that is going to shift because one quarter's revenue is $5 million higher or lower than expected.

F5 reports Tuesday after the close, following a quarter when its stock soared more than 50% to $103 a share, while settling back recently to just over $98 a share. Many of its peers in the layer 4-7 networking market also saw their share prices rise dramatically between July and September, and have followed it up by posting better-than-expected top line growth. Riverbed, for example, was up 65% in the third quarter, and then reported revenue 8% ahead of expectations, and lifted guidance for the December quarter 5%. That stock is now up 100% from where it was July 1st. Citrix saw its value increase 61% in the third quarter, and then reported that its data center revenue grew 47% year-over-year. Moreover, in the slides accompanying its earnings call, Citrix explicitly mentioned that its NetScaler MPX was leading the way in its data center growth, and that product line that competes directly against F5's BIG-IP and VIPRION platforms.

F5 traded up 6% Friday off of Riverbed's better-than-expected earnings report. Additionally, Citrix is its leading competitor, putting additional pressure on the company to outperform. During its last call, F5 gave a top line guidance range of $242 million - $247 million for this quarter, ahead of estimates that were around $230 million. Whisper numbers are pushing $260 million now, and it would likely be a huge disappointment if the company did not lift guidance for next year.

Another factor to look out for is the expectations multiple. Wall Street has largely been overreacting to good and bad news in the heavily watched data center services and networking industries. On its July call, Mellanox announced sequential revenue would decline 7%, and its stock fell more than 30% the next day. On its infamous October 5 warning call, Equinix announced revenue would fall 2% short of guidance, and its stock fell more than 30% the next day. Then last week, Riverbed beat revenue estimates by 8%, and its stock was up more than 18%. The sell-side analysts then started firing out downgrades and upgrades after all these numbers were posted.

It Wall Street-speak, you could say F5 is currently "priced to perfection", especially with the stock getting a 6% bounce of its own off of the Riverbed report. And for years, some have predicted that F5's custom ASICs would eventually lose their lead over the Intel Xeons and merchant silicon used by Netscaler. However, that is not a trend that is going to shift because one quarter's revenue is $5 million higher or lower than expected.

Labels:

FFIV,

Layer 4-7 Hardware

Sunday, October 24, 2010

Citrix Data Center Revenue Up 47%, Led by Netscaler

By David Gross

The expectations for F5's quarterly earnings report this Tuesday got a big boost from Riverbed beating expectations on its call Wednesday, and were lifted further with Citrix reporting that its data center revenue grew 47% year-over-year to $84 million, led by its Netscaler load balancer. Sales of the software-based Netscaler VPX were up 40% sequentially.

Citrix got into the load balancing business in 2005, when it acquired Netscaler for $300 million. The product line brings a sharp contrast to F5, which is still the market leader, in that Netscaler has been built around merchant silicon, including Intel Xeon processors, while F5 has invested significantly in developing its own ASICs. Nonetheless, with tie-ins to the company's XenServer hypervisor, Citrix has vaulted into the number two spot in the load balancer market, although it still trails F5 nearly two-to-one.

In total, Citrix's revenue was up 18% year-over-year to $472 million, with guidance for next quarter of $500-$510 million. But just as we saw with Juniper and VMWare, the company expanded margins by increasing revenue at a much faster rate than operating expenses. Sales and marketing costs increased at less than a quarter of the pace of the revenue gain, moving up just 4%. However, R&D costs rose 27%, but total operating costs still rose just 11%, allowing operating margins to improve from 14% to 17%. Like Juniper, Citrix has been hiring more engineers while keeping marketing and finance headcount fairly flat. But for Citrix, this is a noteworthy achievement, because Layer 4-7 switching generally requires much greater support than L2-3 switching and routing.

The company generated $190 million of cash from operations, with its cash balance now sitting at $1.59 billion, up from $1.2 billion at the beginning of the year. With an $11.4 market cap, it now has an EV/Revenue ratio of 5.5, which is not cheap, but investors can't overlook Citrix's ability to grow its revenue faster than its headcount.

The expectations for F5's quarterly earnings report this Tuesday got a big boost from Riverbed beating expectations on its call Wednesday, and were lifted further with Citrix reporting that its data center revenue grew 47% year-over-year to $84 million, led by its Netscaler load balancer. Sales of the software-based Netscaler VPX were up 40% sequentially.

Citrix got into the load balancing business in 2005, when it acquired Netscaler for $300 million. The product line brings a sharp contrast to F5, which is still the market leader, in that Netscaler has been built around merchant silicon, including Intel Xeon processors, while F5 has invested significantly in developing its own ASICs. Nonetheless, with tie-ins to the company's XenServer hypervisor, Citrix has vaulted into the number two spot in the load balancer market, although it still trails F5 nearly two-to-one.

In total, Citrix's revenue was up 18% year-over-year to $472 million, with guidance for next quarter of $500-$510 million. But just as we saw with Juniper and VMWare, the company expanded margins by increasing revenue at a much faster rate than operating expenses. Sales and marketing costs increased at less than a quarter of the pace of the revenue gain, moving up just 4%. However, R&D costs rose 27%, but total operating costs still rose just 11%, allowing operating margins to improve from 14% to 17%. Like Juniper, Citrix has been hiring more engineers while keeping marketing and finance headcount fairly flat. But for Citrix, this is a noteworthy achievement, because Layer 4-7 switching generally requires much greater support than L2-3 switching and routing.

The company generated $190 million of cash from operations, with its cash balance now sitting at $1.59 billion, up from $1.2 billion at the beginning of the year. With an $11.4 market cap, it now has an EV/Revenue ratio of 5.5, which is not cheap, but investors can't overlook Citrix's ability to grow its revenue faster than its headcount.

Labels:

CTXS,

FFIV,

Layer 4-7 Hardware

Friday, October 22, 2010

Riverbed Soaring Today After Earnings Report, Bringing F5 Up With It

By David Gross

Following yesterday's earnings report, Riverbed is soaring today, up over 20% in afternoon trading. Revenue came in at $147 million, ahead of guidance of $136 million, with EPS beating by six cents. The company offered guidance of $155 million to $158 million for next quarter, ahead of expectations of $150 million. Volume is approaching 7 million shares, well ahead of the 2.5 million it does in a typical day - and the more stocks trade hands, the more data centers benefit. The good news has spread to other leading L4-7 networkers, most notably F5 (FFIV), which reports after Tuesday's close, and is up 5% to 97.33, it's highest level since Goldman Sachs came out with its oddly-reasoned research note downgrading the company two weeks ago.

Nonetheless, this is yet another Wall Street overreaction. Just as Equinix (EQIX) did not deserve to lose a third of its value over a 2% drop in revenue guidance, Riverbed's ability to beat top line estimates by 8%, with a 5% upward revision for next quarter, does not justify a 20% increase in one day. The company helped fuel this manic buying by announcing that it will split its stock next month.

There is no question that this is a well run company that has taken share away from Cisco (CSCO), Packeteer/Blue Coat (BCSI), and Juniper (JNPR) to become the leading TCP Acceleration/WAN Optimization vendor, but the Wall Street's overreactions are themselves probably creating more near term opportunities for investors than fundamentals.

Following yesterday's earnings report, Riverbed is soaring today, up over 20% in afternoon trading. Revenue came in at $147 million, ahead of guidance of $136 million, with EPS beating by six cents. The company offered guidance of $155 million to $158 million for next quarter, ahead of expectations of $150 million. Volume is approaching 7 million shares, well ahead of the 2.5 million it does in a typical day - and the more stocks trade hands, the more data centers benefit. The good news has spread to other leading L4-7 networkers, most notably F5 (FFIV), which reports after Tuesday's close, and is up 5% to 97.33, it's highest level since Goldman Sachs came out with its oddly-reasoned research note downgrading the company two weeks ago.

Nonetheless, this is yet another Wall Street overreaction. Just as Equinix (EQIX) did not deserve to lose a third of its value over a 2% drop in revenue guidance, Riverbed's ability to beat top line estimates by 8%, with a 5% upward revision for next quarter, does not justify a 20% increase in one day. The company helped fuel this manic buying by announcing that it will split its stock next month.

There is no question that this is a well run company that has taken share away from Cisco (CSCO), Packeteer/Blue Coat (BCSI), and Juniper (JNPR) to become the leading TCP Acceleration/WAN Optimization vendor, but the Wall Street's overreactions are themselves probably creating more near term opportunities for investors than fundamentals.

Labels:

Layer 4-7 Hardware,

RVBD

Sunday, October 17, 2010

Silver Peak Adds Partner for Data Center WAN Optimization

By David Gross

Privately-held Silver Peak has been among the most quiet of the layer 4-7 acceleration vendors lately. But Friday, the company spoke up and announced it had a new partner in Japan, Netmarks, for distributing its equipment in the Asian country.

Silver Peak has been looking for a niche to fill, and competing against publicly-traded companies like Riverbed (RVBD), Blue Coat (BCSI), Cisco (CSCO), and Juniper (JNPR), its message often gets lost in the all noise. The company, originally known as Cheyenne Networks, was founded in 2004, not long after Riverbed was, but also not long before Riverbed' started to surpass Packeteer, before that company's takeover by Blue Coat.

The company has raised over $60 million since its founding in 2004, $4 million of which came earlier this month. Its investors include Greylock, Benchmark Capital and Pinnacle Ventures.

While Riverbed and others have put a lot of effort into mobile apps, Silver Peak has re-focused itself on the data center. This is really more of a marketing decision than one of technical specs, because there is a lot of common technology across these plaforms, from http pre-fetch to CIFS accleration, and WAN latency has far more to do with the physical medium - fiber, satellite, etc - than whether the network end point is a data center or corporate office building. Nonethless, concentrating sales and marketing in one area is a sensible strategy for Silver Peak with so many larger competitors in the market.

Privately-held Silver Peak has been among the most quiet of the layer 4-7 acceleration vendors lately. But Friday, the company spoke up and announced it had a new partner in Japan, Netmarks, for distributing its equipment in the Asian country.

Silver Peak has been looking for a niche to fill, and competing against publicly-traded companies like Riverbed (RVBD), Blue Coat (BCSI), Cisco (CSCO), and Juniper (JNPR), its message often gets lost in the all noise. The company, originally known as Cheyenne Networks, was founded in 2004, not long after Riverbed was, but also not long before Riverbed' started to surpass Packeteer, before that company's takeover by Blue Coat.

The company has raised over $60 million since its founding in 2004, $4 million of which came earlier this month. Its investors include Greylock, Benchmark Capital and Pinnacle Ventures.

While Riverbed and others have put a lot of effort into mobile apps, Silver Peak has re-focused itself on the data center. This is really more of a marketing decision than one of technical specs, because there is a lot of common technology across these plaforms, from http pre-fetch to CIFS accleration, and WAN latency has far more to do with the physical medium - fiber, satellite, etc - than whether the network end point is a data center or corporate office building. Nonethless, concentrating sales and marketing in one area is a sensible strategy for Silver Peak with so many larger competitors in the market.

Labels:

Layer 4-7 Hardware,

WAN Acceleration

Friday, October 15, 2010

Radware Releases New Software for Key Data Center Applications

By David Gross

The load balancer, I mean layer 4-7 switching, or "application delivery controller" market has gotten extremely competitive with F5 (FFIV), Citrix (CTXS), Cisco (CSCO), Radware (RDWR), and Coyote Point all fighting to expand their presence in data centers, regardless of what new names their marketing departments create for the product category. Radware stepped up its presence in this sector earlier this year when it bought Nortel's Alteon division for $18 million, a company Nortel itself bought in 2000 for $6 billion. Yes, that's three/tenths of a penny on the dollar. Recession and bankruptcy are good at producing opportunities like this.

Radware is continuing to invest in the Alteon line, and just released a new version of the software that supports the platform, OS 27. Just in case you're keeping score, F5 is on version 10 with its TMOS software, and Citrix is on 9 with its Netscaler O/S. Radware claims the new software will decrease response times for key applications like SharePoint, Siebel, and PeopleSoft by up to 350%. The company also sees the software improving performance of virtualized apps, and is already a member of VMWare's (VMW) Technology Alliance Program.

Radware stock has been holding steady in the mid-30s since last week's Equinix sell-off on relatively light volumes. The company reports earnings October 27th.

The load balancer, I mean layer 4-7 switching, or "application delivery controller" market has gotten extremely competitive with F5 (FFIV), Citrix (CTXS), Cisco (CSCO), Radware (RDWR), and Coyote Point all fighting to expand their presence in data centers, regardless of what new names their marketing departments create for the product category. Radware stepped up its presence in this sector earlier this year when it bought Nortel's Alteon division for $18 million, a company Nortel itself bought in 2000 for $6 billion. Yes, that's three/tenths of a penny on the dollar. Recession and bankruptcy are good at producing opportunities like this.

Radware is continuing to invest in the Alteon line, and just released a new version of the software that supports the platform, OS 27. Just in case you're keeping score, F5 is on version 10 with its TMOS software, and Citrix is on 9 with its Netscaler O/S. Radware claims the new software will decrease response times for key applications like SharePoint, Siebel, and PeopleSoft by up to 350%. The company also sees the software improving performance of virtualized apps, and is already a member of VMWare's (VMW) Technology Alliance Program.

Radware stock has been holding steady in the mid-30s since last week's Equinix sell-off on relatively light volumes. The company reports earnings October 27th.

Labels:

Layer 4-7 Hardware,

RDWR

Wednesday, September 8, 2010

Is it Time to Sell F5?

by David Gross

Few stocks have performed like F5 (FFIV) over the last year. It's risen over 150% the last 12 months, while NASDAQ has eeked out a 9% gain, and rival Cisco (CSCO) has fallen 5%. Its other chief competitor, Citrix (CTXS), has risen just 71%, less than half as much as F5, renewing calls that the stock is overvalued, and ready for a fall.

F5's rise over the last few years has climbed a wall of worry. When it hit $26 in April 2009, UBS downgraded it citing valuation concerns. Since then, the stock has risen more than three-fold. Moreover, the fundamentals have remained very strong, with top line growth exceeding 40%, the cash balance growing and nearing $900 million, negligible long-term debt, a workforce that produces nearly 50% more revenue per head than rival Citrix, and Cisco (CSCO) still struggling to find its way in the load balancing market.

Between 2000 and 2003, F5's annual revenue was essentially flat, bouncing around between $108 million and $116 million. Since then, it's grown eight-fold, with last quarter's revenue coming in at $230 million. With the exception of 2009, when it grew just 0.5% due to the recession, the company's top line growth has come in anywhere between 24% and 64% since 2004. If it hits its guidance in its fiscal 4th quarter for 2010, which ends this month, it will report 34% growth for 2010.

From 2005 and 2007, the company's growth rate was nearly cut in half, from 64% to 33%, before the recession began. While many are expecting lower growth in 2011, Wall Street hasn't treated the stock well when its growth rate has slowed. From August 2007 to March 2008, when growth was decelerating, but still over 20% year-over-year, the stock lost 58% of its value, a period during which NASDAQ fell just 15%.

The current enterprise value/annualized earnings ratio of 41 is certainly high, but nothing like its obscene late 1999 valuation when the company was 96% smaller than it is now, generated nearly a quarter of its revenue from a soon-to-be-bankrupt Exodus, but had a market cap just 20% lower than today's soaring value. Moreover, many of the product lines it competed against then, such as Cisco/ArrowPoint, Nortel/Alteon/Radware, and Foundry/Brocade, are the same, yet have struggled amid mergers, acquisitions, and management focus on other product categories. So while the long term story for F5 continues to look very good, the sudden price drops that have accompanied its periods of slowing growth should make investors think twice before getting in at these levels.

Few stocks have performed like F5 (FFIV) over the last year. It's risen over 150% the last 12 months, while NASDAQ has eeked out a 9% gain, and rival Cisco (CSCO) has fallen 5%. Its other chief competitor, Citrix (CTXS), has risen just 71%, less than half as much as F5, renewing calls that the stock is overvalued, and ready for a fall.

F5's rise over the last few years has climbed a wall of worry. When it hit $26 in April 2009, UBS downgraded it citing valuation concerns. Since then, the stock has risen more than three-fold. Moreover, the fundamentals have remained very strong, with top line growth exceeding 40%, the cash balance growing and nearing $900 million, negligible long-term debt, a workforce that produces nearly 50% more revenue per head than rival Citrix, and Cisco (CSCO) still struggling to find its way in the load balancing market.

Between 2000 and 2003, F5's annual revenue was essentially flat, bouncing around between $108 million and $116 million. Since then, it's grown eight-fold, with last quarter's revenue coming in at $230 million. With the exception of 2009, when it grew just 0.5% due to the recession, the company's top line growth has come in anywhere between 24% and 64% since 2004. If it hits its guidance in its fiscal 4th quarter for 2010, which ends this month, it will report 34% growth for 2010.

From 2005 and 2007, the company's growth rate was nearly cut in half, from 64% to 33%, before the recession began. While many are expecting lower growth in 2011, Wall Street hasn't treated the stock well when its growth rate has slowed. From August 2007 to March 2008, when growth was decelerating, but still over 20% year-over-year, the stock lost 58% of its value, a period during which NASDAQ fell just 15%.

The current enterprise value/annualized earnings ratio of 41 is certainly high, but nothing like its obscene late 1999 valuation when the company was 96% smaller than it is now, generated nearly a quarter of its revenue from a soon-to-be-bankrupt Exodus, but had a market cap just 20% lower than today's soaring value. Moreover, many of the product lines it competed against then, such as Cisco/ArrowPoint, Nortel/Alteon/Radware, and Foundry/Brocade, are the same, yet have struggled amid mergers, acquisitions, and management focus on other product categories. So while the long term story for F5 continues to look very good, the sudden price drops that have accompanied its periods of slowing growth should make investors think twice before getting in at these levels.

Labels:

FFIV,

Layer 4-7 Hardware

Subscribe to:

Posts (Atom)