By David Gross

Rackspace met sell-side expectations with an EPS of 9 cents, and revenue beat by 1% at $199.7 million. Normally, I don't like getting into this EPS-by-a-penny chase, but Wall Street can't help but have emotional responses to news in this industry. Even though Rackspace hit public estimates, it fell slightly short of a Morgan Stanley estimate of 10 cents that was published this afternoon in Investor's Business Daily. The stock fell 5% after hours after the earnings report hit the wire, but has come back a bit and is now down 2%.

Cloud continues to be less than 20% of revenue, but over 80% of the hype, but was up sequentially from 12.4% of revenue to 13.4%. More important to profitability, the company's SG&A/Revenue ratio continued its decline, dropping 44 points sequentially to 36.94%, and down 2.15 percentage points year-over-year. This boring, but financially significant detail, is the main reason why earnings growth has been 55% over the last 12 months while revenue growth has been 23%. But with the company saying "cloud" as if they get a multiple off of how many times they can they the word, don't expect a lot of news about techniques to control SG&A costs.

Showing posts with label RAX. Show all posts

Showing posts with label RAX. Show all posts

Monday, November 8, 2010

Rackspace Hits Expectations, Down 2% After Hours

Labels:

RAX

Rackspace Earnings Preview

By David Gross

Rackspace reports after the close today, here are a couple things to look out for:

While y/y top line growth last quarter was in the low 20s, the company's current valuation of 74x annualized earnings is just above its 60% y/y growth in bottom line profitability. Continued reductions in its SG&A/Revenue ratio are essential to maintaining such a high valuation. Still, watch out for a sharp reaction on Tuesday if top line guidance surprises in any way.

Rackspace reports after the close today, here are a couple things to look out for:

- An Expectations Multiple off of Guidance, Actual Revenue, or Actual Earnings.

- The Growth Rate in Managed Services Revenue

- Continued Reductions in SG&A Costs as a Share of Revenue

While y/y top line growth last quarter was in the low 20s, the company's current valuation of 74x annualized earnings is just above its 60% y/y growth in bottom line profitability. Continued reductions in its SG&A/Revenue ratio are essential to maintaining such a high valuation. Still, watch out for a sharp reaction on Tuesday if top line guidance surprises in any way.

Labels:

RAX

Thursday, October 28, 2010

Dallas Data Centers

By David Gross

About to host its first World Series, the Dallas/Ft. Worth Metroplex is growing by nearly 150,000 people a year, and is now the largest metro area between Chicago and California. It also represents one of the most interesting data center markets in the U.S.. Its tenant mix reflects its deep legacy in telecommunications, with the million square foot+ Infomart building at 1950 North Stemmons representing the city's equivalent to 111 8th Avenue or 350 East Cermak, and just about every telecom provider serving a business co-locating, cross-connecting, or exchanging traffic there. Beyond telecommunications, there are two defining traits of the Dallas market: hosting companies and an outsized presence by Digital Realty.

Dallas' strength with hosting providers is tied to the GI Partners/Digital Realty dominance of the market, as well as a lucky (or smart) situation Rackspace walked into six years ago. While I have focused here on data centers where there is a well-known publicly traded company owning or leasing space, which means my list is not entirely comprehensive, Dallas is very different that other large data center markets in that DuPont Fabros, Coresite, and Equinix have a very limited presence in the DFW area. While Equinix is expanding here, it currently leases space from Digital Realty, which outside of the large Infomart carrier hotel, essentially owns the market.

Digital Realty owns over 2 million square feet of space in the DFW Metroplex, including nearly a million that it is developing in the telecom corridor in Richardson. While GI Partners no longer owns Digital Realty, it does own SoftLayer, which it merged with The Planet, and got into a lease at 4849 Alpha Road, just to the west of Digital Realty's Richardson cluster. GI Partners portfolio company Telx (which is still in registration), also leases space from Digital Realty at 2323 Bryan Street downtown, which additionally hosts an Equinix facility.

Dallas does not have the financial traders that New York and Chicago do, it does not have media and content providers that LA does, and it does not have the Facebook, Amazon, Google, or Microsoft centers Silicon Valley and Northern Virginia do. But in addition to being one of the largest mid-continent connection points for telecom providers, it is a hub for web hosters, including Rackspace.

Through Qwest, Rackspace is subleasing 144,000 square feet at 801 Industrial Boulevard near DFW airport, representing about 80% of its entire data center footprint. Rackspace sublet the space in 2004, when Qwest was pulling back from its late 90s/early 2000s expansion, and is paying just $11.25 per square foot triple net, and that's with the price escalators kicking in from the original sublease agreement. This deal runs through August 31, 2015, at which point Rackspace will likely be paying at least double, if not quite a bit more, for new space. The balance of Rackspace's facilities are in DuPont Fabros' Elk Grove Village, IL and Ashburn, VA buildings.

View Dallas Data Centers in a larger map

The Rackspace lease expiration will be interesting to watch, particularly because it is not part of the GI Partners investment family, like Digital Realty, Telx, and SoftLayer are.

Beyond Rackspace and SoftLayer, Dallas tenants include Horizon Data Centers, Perot Systems, TD Ameritrade, and the FAA, which leases a building in Fort Worth from Digital Realty, in addition to leasing another DLR property in Northern Virginia. But with a less established base in one industry than places like Northern Virginia or Silicon Valley have, Dallas is still defining itself as a data center market, and could change dramatically as it continues to grow.

About to host its first World Series, the Dallas/Ft. Worth Metroplex is growing by nearly 150,000 people a year, and is now the largest metro area between Chicago and California. It also represents one of the most interesting data center markets in the U.S.. Its tenant mix reflects its deep legacy in telecommunications, with the million square foot+ Infomart building at 1950 North Stemmons representing the city's equivalent to 111 8th Avenue or 350 East Cermak, and just about every telecom provider serving a business co-locating, cross-connecting, or exchanging traffic there. Beyond telecommunications, there are two defining traits of the Dallas market: hosting companies and an outsized presence by Digital Realty.

Dallas' strength with hosting providers is tied to the GI Partners/Digital Realty dominance of the market, as well as a lucky (or smart) situation Rackspace walked into six years ago. While I have focused here on data centers where there is a well-known publicly traded company owning or leasing space, which means my list is not entirely comprehensive, Dallas is very different that other large data center markets in that DuPont Fabros, Coresite, and Equinix have a very limited presence in the DFW area. While Equinix is expanding here, it currently leases space from Digital Realty, which outside of the large Infomart carrier hotel, essentially owns the market.

Digital Realty owns over 2 million square feet of space in the DFW Metroplex, including nearly a million that it is developing in the telecom corridor in Richardson. While GI Partners no longer owns Digital Realty, it does own SoftLayer, which it merged with The Planet, and got into a lease at 4849 Alpha Road, just to the west of Digital Realty's Richardson cluster. GI Partners portfolio company Telx (which is still in registration), also leases space from Digital Realty at 2323 Bryan Street downtown, which additionally hosts an Equinix facility.

Dallas does not have the financial traders that New York and Chicago do, it does not have media and content providers that LA does, and it does not have the Facebook, Amazon, Google, or Microsoft centers Silicon Valley and Northern Virginia do. But in addition to being one of the largest mid-continent connection points for telecom providers, it is a hub for web hosters, including Rackspace.

Through Qwest, Rackspace is subleasing 144,000 square feet at 801 Industrial Boulevard near DFW airport, representing about 80% of its entire data center footprint. Rackspace sublet the space in 2004, when Qwest was pulling back from its late 90s/early 2000s expansion, and is paying just $11.25 per square foot triple net, and that's with the price escalators kicking in from the original sublease agreement. This deal runs through August 31, 2015, at which point Rackspace will likely be paying at least double, if not quite a bit more, for new space. The balance of Rackspace's facilities are in DuPont Fabros' Elk Grove Village, IL and Ashburn, VA buildings.

View Dallas Data Centers in a larger map

The Rackspace lease expiration will be interesting to watch, particularly because it is not part of the GI Partners investment family, like Digital Realty, Telx, and SoftLayer are.

Beyond Rackspace and SoftLayer, Dallas tenants include Horizon Data Centers, Perot Systems, TD Ameritrade, and the FAA, which leases a building in Fort Worth from Digital Realty, in addition to leasing another DLR property in Northern Virginia. But with a less established base in one industry than places like Northern Virginia or Silicon Valley have, Dallas is still defining itself as a data center market, and could change dramatically as it continues to grow.

| Dallas Data Centers – Major Public Companies Owning/Leasing | ||||

| Address | Sq Ft | Owner | Tenants | |

| 1950 N Stemmons Freeway | Dallas | 1,500,000 | DCI Tech/Infomart | the Dallas version of 111 8th Ave or 350 E. Cermak |

| 8435 N Stemmons Freeway | Dallas | 21,000 | Office Building | Telx Leases a Floor for Co-lo |

| 2323 Bryan Street | Dallas | 457,000 | Digital Realty | Telx, Equinix (DA4) |

| 2440 Marsh Lane | Carrollton | 135,000 | Digital Realty | TD Ameritrade |

| 11830 Webb Chapel Road | Farmers Branch | 365,000 | Digital Realty | Perot Systems |

| 14901 FAA Boulevard | Fort Worth | 263,000 | Digital Realty | FAA |

| 904 Quality Way | Richardson | 47,000 | Digital Realty | Under Development |

| 905 Security Row | Richardson | 250,000 | Digital Realty | Under Development |

| 1232 Alma Road | Richardson | 106,000 | Digital Realty | Terremark |

| 900 Quality Way | Richardson | 112,000 | Digital Realty | Under Development |

| 1400 North Bowser Road | Richardson | 247,000 | Digital Realty | Under Development |

| 1301 International Parkway | Richardson | 20,000 | Digital Realty | Under Development |

| 4849 Alpha Road | Farmers Branch | 60,000 | Digital Realty | SoftLayer (also HQ office) |

| 400 South Akard Street | Dallas | 36,000 | Fed Reserve | Downtown Carrier Hotel |

| 4025 Midway Road | Farmers Branch | 88,000 | Digital Realty | Horizon |

| 3180 Irving Blvd | Dallas | 58,000 | Level 3 | Terremark |

| 801 Industrial Boulevard | Grapevine | 144,000 | ING Clarion | Rackspace Primary U.S. Data Center – Sublease from Qwest |

| 3,909,000 | ||||

| DataCenterStocks.com |

Labels:

Dallas Data Centers,

Data Center REITs,

DLR,

RAX

Tuesday, October 19, 2010

Rackspace Surpasses 2 Million Business E-Mail Accounts

By David Gross

Rackspace (RAX) recently announced that it has surpassed 2 million hosted e-mail accounts, up from 600,000 three years ago when it acquired Webmail.us. The company's hosted e-mail service centers on its proprietary e-mail, as well as Microsoft Exchange. Additionally, it offers a hybrid service that lets users of either system share calendaring and collaboration tools.

Since acquiring Webmail, Rackspace has kept the acquired company's Blacksburg, Virginia offices. Blacksburg is home to Virginia Tech, and is four hours from the expensive Northern Virginia labor market, a factor which helps Rackspace avoid some of the high labor costs it would see if it had more people near DC. This is also important for a company that has close to 3,000 employees, is in a very labor-intensive business, with just $250,000 of revenue per employee, and is based in low cost San Antonio, not Santa Clara, Secaucus, or Ashburn.

At the time of the merger, Webmail (which was re-named Mailtrust after the acquisition) had 70,000 customers, or about nine e-mail boxes per company. Rackspace did not say how many companies were represented by the 2 million accounts it has now, but the reference customer in its press release had over 2,000 e-mail boxes. Moreover, if it hadn't grown the number of e-mail accounts per company, it would have around 250,000 companies using its hosted e-mail service, which would be difficult to believe.

Rackspace has not announced a date for its next quarterly earnings call, and reports on a standard calendar quarter. However, it typically waits until the end of earnings season, so the call probably will not take place for another few weeks.

Rackspace (RAX) recently announced that it has surpassed 2 million hosted e-mail accounts, up from 600,000 three years ago when it acquired Webmail.us. The company's hosted e-mail service centers on its proprietary e-mail, as well as Microsoft Exchange. Additionally, it offers a hybrid service that lets users of either system share calendaring and collaboration tools.

Since acquiring Webmail, Rackspace has kept the acquired company's Blacksburg, Virginia offices. Blacksburg is home to Virginia Tech, and is four hours from the expensive Northern Virginia labor market, a factor which helps Rackspace avoid some of the high labor costs it would see if it had more people near DC. This is also important for a company that has close to 3,000 employees, is in a very labor-intensive business, with just $250,000 of revenue per employee, and is based in low cost San Antonio, not Santa Clara, Secaucus, or Ashburn.

At the time of the merger, Webmail (which was re-named Mailtrust after the acquisition) had 70,000 customers, or about nine e-mail boxes per company. Rackspace did not say how many companies were represented by the 2 million accounts it has now, but the reference customer in its press release had over 2,000 e-mail boxes. Moreover, if it hadn't grown the number of e-mail accounts per company, it would have around 250,000 companies using its hosted e-mail service, which would be difficult to believe.

Rackspace has not announced a date for its next quarterly earnings call, and reports on a standard calendar quarter. However, it typically waits until the end of earnings season, so the call probably will not take place for another few weeks.

Labels:

RAX

Friday, October 15, 2010

Pacific Crest Downgrades Rackspace

By David Gross

Yesterday, Pacific Crest downgraded Rackspace (RAX) on valuation concerns. The analyst cited an EV/EBITDA ratio of 10.4 on 2011 estimates as being too high for their liking. Can't say I disagree too strongly. RAX, while being a very-well run company, is up 40% since I wrote this article about them in July.

That said, the analyst also popped in something about the Equinix (EQIX) warning from last week, which is ridiculous. I've never seen a 2% drop in revenue guidance cause so much uproar. What's next, is Obama going to say something about it?

Yesterday, Pacific Crest downgraded Rackspace (RAX) on valuation concerns. The analyst cited an EV/EBITDA ratio of 10.4 on 2011 estimates as being too high for their liking. Can't say I disagree too strongly. RAX, while being a very-well run company, is up 40% since I wrote this article about them in July.

That said, the analyst also popped in something about the Equinix (EQIX) warning from last week, which is ridiculous. I've never seen a 2% drop in revenue guidance cause so much uproar. What's next, is Obama going to say something about it?

Sunday, October 10, 2010

Ashburn Data Centers

By David Gross

In Northern Virginia, many of our telecom carriers went bankrupt in the early-mid 2000s. The region spent much of the last decade shifting its emphasis from being a leading hub for ISPs and CLECs, back to its more traditional role in government contracting. However, data centers held on due to the unusually large amount of fiber optic capacity and interconnection points that already existed in the region, and centered in on one area - Ashburn - for their large expansions.

Ashburn sits in the middle of rapidly growing Loudoun County, a few miles to the north of Dulles Airport. Anyone who has visited the Equinix (EQIX), Digital Realty (DLR), or DuPont Fabros (DFT) facilities there has seen the planes, including many European flag carriers, flying right over the data center clusters on Beaumeade Circle/Filigree Court and Devin Shafron Drive.

The first major facility to go up in Ashburn was Equinix's DC1 in 1999. When it was built, many thought it was too far out, and that it might have been better off closer to the large MAE East NAP in Tyson's Corner, 15 miles east, which along with MAE West in Silicon Valley passed more Internet traffic than just about any location in the world. And with interconnection the centerpiece of the co-location business, proximity to both fiber and existing peering locations were highly important. But land costs are much lower in Ashburn, as are existing building densities, two factors which have made it conducive to large, 100,000+ square foot facilities, while the smaller data centers have tended to stay to the east in Fairfax County and downtown DC.

Today, there is just over 2 million square feet of public data center space in the Ashburn area, including the Savvis-operated/DLR-owned facilities a couple miles away on Ridgetop Circle and Nokes Boulevard, which have a Sterling address. Those facilities are adjacent to the Dulles Town Center mall, which itself was built in 1999, and are surrounded by shopping centers, and new apartment and townhouse developments. Meanwhile, the Ashburn clusters tend to be slightly more rural, sitting west of Route 28, which runs right into the Dulles Airport entrance, and used to mark the end of civilization for many DC area residents.

The primary hub for data centers in Ashburn is a collection of interconnected roads - Beaumeade Circle, Hastings Drive, Chillum Place, and Filigree Court, which are less than a mile down Loudoun County Parkway from the Washington Redskins training facility. The large former WorldCom/now Verizon Business office complex is another mile down Loudoun County Parkway. And if you continue another half mile down that road, you come to the DLR cluster at Devin Shafron Drive.

On Devin Shafron, there is a small patch of dirt and grass with a Digital Realty "for lease" sign in front, while nearby on Red Rum Drive, office REIT First Potomac Realty (FPO) recently bought the Corporate Campus at Ashburn Center, 123,000 feet of which are leased to managed hosting provider Latisys, which held a grand opening there last Thursday. Among the established properties, Equinix's DC2 has long been the place to be, with a long list of financial, media, and telecom clients including MasterCard, The Motley Fool, Level 3, Internap, Electronic Arts, BT North America, and Accenture. Around the corner from there on Hastings Drive, DC-based DFT has attracted its own set of brand name clients with Rackspace, Facebook, Yahoo, and Match.com.

This tenant mix in Ashburn reflects that this is the leading east coast data center hub, bringing together some of the largest telecom providers and most highly visited websites in the world. In the 2010s, Ashburn is carrying on Northern Virginia's 1990s legacy as the hub of ISPs and internet connectivity.

In Northern Virginia, many of our telecom carriers went bankrupt in the early-mid 2000s. The region spent much of the last decade shifting its emphasis from being a leading hub for ISPs and CLECs, back to its more traditional role in government contracting. However, data centers held on due to the unusually large amount of fiber optic capacity and interconnection points that already existed in the region, and centered in on one area - Ashburn - for their large expansions.

Ashburn sits in the middle of rapidly growing Loudoun County, a few miles to the north of Dulles Airport. Anyone who has visited the Equinix (EQIX), Digital Realty (DLR), or DuPont Fabros (DFT) facilities there has seen the planes, including many European flag carriers, flying right over the data center clusters on Beaumeade Circle/Filigree Court and Devin Shafron Drive.

The first major facility to go up in Ashburn was Equinix's DC1 in 1999. When it was built, many thought it was too far out, and that it might have been better off closer to the large MAE East NAP in Tyson's Corner, 15 miles east, which along with MAE West in Silicon Valley passed more Internet traffic than just about any location in the world. And with interconnection the centerpiece of the co-location business, proximity to both fiber and existing peering locations were highly important. But land costs are much lower in Ashburn, as are existing building densities, two factors which have made it conducive to large, 100,000+ square foot facilities, while the smaller data centers have tended to stay to the east in Fairfax County and downtown DC.

Today, there is just over 2 million square feet of public data center space in the Ashburn area, including the Savvis-operated/DLR-owned facilities a couple miles away on Ridgetop Circle and Nokes Boulevard, which have a Sterling address. Those facilities are adjacent to the Dulles Town Center mall, which itself was built in 1999, and are surrounded by shopping centers, and new apartment and townhouse developments. Meanwhile, the Ashburn clusters tend to be slightly more rural, sitting west of Route 28, which runs right into the Dulles Airport entrance, and used to mark the end of civilization for many DC area residents.

The primary hub for data centers in Ashburn is a collection of interconnected roads - Beaumeade Circle, Hastings Drive, Chillum Place, and Filigree Court, which are less than a mile down Loudoun County Parkway from the Washington Redskins training facility. The large former WorldCom/now Verizon Business office complex is another mile down Loudoun County Parkway. And if you continue another half mile down that road, you come to the DLR cluster at Devin Shafron Drive.

|

| DLR's new data center at 43915 Devin Shafron Drive |

On Devin Shafron, there is a small patch of dirt and grass with a Digital Realty "for lease" sign in front, while nearby on Red Rum Drive, office REIT First Potomac Realty (FPO) recently bought the Corporate Campus at Ashburn Center, 123,000 feet of which are leased to managed hosting provider Latisys, which held a grand opening there last Thursday. Among the established properties, Equinix's DC2 has long been the place to be, with a long list of financial, media, and telecom clients including MasterCard, The Motley Fool, Level 3, Internap, Electronic Arts, BT North America, and Accenture. Around the corner from there on Hastings Drive, DC-based DFT has attracted its own set of brand name clients with Rackspace, Facebook, Yahoo, and Match.com.

This tenant mix in Ashburn reflects that this is the leading east coast data center hub, bringing together some of the largest telecom providers and most highly visited websites in the world. In the 2010s, Ashburn is carrying on Northern Virginia's 1990s legacy as the hub of ISPs and internet connectivity.

| Ashburn Data Centers | |||

| Rentable Sq Ft | Tenants | ||

| DFT | ACC2 44490 Chillum Place | 53,000 | Yahoo |

| ACC3 Hastings Drive | 80,000 | ||

| ACC4 44480 Hastings Drive | 172,000 | Rackspace, Yahoo, Match.com., Facebook | |

| ACC5 Phase 1 | 86,000 | ||

| ACC5 Phase 2 | 86,000 | ||

| 477,000 | |||

| DLR | 21561/21571 Beaumeade Circle | 164,453 | AT&T |

| 43881 Devin Shafron Drive | 180,000 | FAA | |

| 43791 Devin Shafron Drive | 132,086 | Morgan Stanley | |

| 43831 Devin Shafron Drive | 180,000 | Amazon.com | |

| 43915 Devin Shafron Drive | 132,000 | ||

| 21110 Ridgetop Circle, Sterling | 135,513 | Savvis | |

| 45901/45845 Nokes Boulevard, Sterling | 167,160 | Savvis | |

| 44470 Chillum Place | 95,440 | Equinix (DC3) | |

| 1,186,652 | |||

| EQIX | 44470 Chillum Place | Leased from DLR | DC3 |

| 21715 Filigree Court | 147,600 | DC2 | |

| 21701 Filigree Court | 92,000 | DC5 | |

| 21711 Filigree Court | 43,000 | DC1 | |

| 21721 Filigree Ct. | 148,000 | DC6 | |

| 21691 Filigree Court | 100,000 | DC4 | |

| 530,600 | |||

| First Potomac Realty | |||

| 21635 Red Rum Drive | 123,000 | Latisys | |

| Total | 2,317,252 |

Monday, October 4, 2010

Will CENX Beat Equinix in Ethernet Exchanges?

By David Gross

Ethernet exchanges have rapidly become the flavor-of-the-month in telecom services. Just about every provider offering some kind of data center interconnection, business Ethernet, or corporate VoIP service has announced they are offering an Ethernet Exchange platform, or has built a connection to one. A remarkably quick development for a service that didn't really launch until late last year.

Turning Ethernet into Frame Relay

While Ethernet Exchange services are fairly new, the interconnection technology that supports them has been under development for about five years. The need for Ethernet Exchanges arose out of carrier frustration with the nonstandard connection guidelines for handing off Ethernet traffic to other service providers. This problem kept growing as many Ethernet customers were using the technology as a private data service to connect buildings, not as an Internet access service as 2001-era Ethernet providers like Yipes and Telseon were advocating.

As businesses started using Ethernet to connect locations beyond metro areas, their traffic had to be sent through multiple carrier networks, which created all kind of custom configuration requests, in addition to QoS and management issues. Essentially, Ethernet had become a shared network private data service like Frame Relay, except without an NNI (Network-to-Network-Interface) reference to make carrier handoffs simple to configure and reliable to operate.

The MEF (Metro Ethernet Forum) took up this issue around 2005, and got to work on an NNI standard to allow carriers to hand over Ethernet traffic like they had been doing for years with Frame Relay/ATM traffic. The President of the MEF, Nan Chen, also saw this as a business opportunity, and started CENX, or Carrier Ethernet Network Exchange, which launched about a year ago. The benefit of this service is to eliminate the requirement that carriers connect to each other at multiple points throughout their networks, and instead just build a single link (or a handful of links) to the exchange.

CENX vs. Equinix vs. Telx/Neutral Tandem

At the same time that CENX launched, Equinix (EQIX) developed a competing service based on the new MEF NNI specification. Equinix already had all the major service providers sitting in its IBX centers, a big advantage for establishing this kind of service. Another co-lo provider, Telx, entered the market in June, through a partnership with Neutral Tandem (TNDM) which already provided a third-party interconnection service for cell phone carriers and VoIP carriers who needed to interconnect voice traffic with long distance networks. Neutral Tandem co-founder Ron Gavillet is also the co-founder of CENX.

Competitively, the data center co-lo providers are now fighting a startup, one that has been very successful with large carriers, announcing last week that Cox Business would be coming into its exchange, in addition to Verizon (VZ), Level 3 (LVLT), and China Telecom who are already there. Equinix also has Level 3 as a customer in addition to AboveNet (ABVT), all three of whom are components of our DataCenterStocks.com Services Index.

CENX makes the claim that it's completely neutral, and does not compete with its carrier customers for corporate accounts like Equinix and Telx do. While this might be technically true, competing with customers has never held back Verizon Wholesale or the wholesale telecom market in general. Carriers have long given business to their competitors in order to provide greater network reach for their other customers. Additionally, Nan Chen is also still President of the MEF, which represents both carriers and vendors, so there are conflicts on all sides - never a surprise in wholesale telecom. A greater advantage for CENX than its claim to be conflict-free is focus, which has been the key to success for most data center service providers. Digital Realty (DLR), Equinix, Rackspace (RAX), and Akamai (AKAM) have the highest market caps in this sector, and also the narrowest product lines - they don't mix co-lo with managed services, or CDNs with bandwidth sales.

Interconnection Margins Are Typically Higher than Bandwidth Margins

CENX has an odd "let's keep things quiet" strategy that extends to who has actually financed them. That said, margins on interconnection services are typically higher than traditional bandwidth services because there is no need to spend capital on laterals to office buildings, and sales costs are reasonably low because there is no need to reach out and get a message out to small or mid-size business. Additionally, sales cycles are often shorter than they are for long-term bandwidth or IRU contracts. Neutral Tandem's financials reflect this, with net margins around 20%, gross margins in the high 60s, and a Revenue/PP&E ratio over 3 - all much higher than those of its carrier customers.

Wall Street fell out of love with Neutral Tandem when revenue flattened at around $45 million a quarter, which occurred even when VoIP and cell phone minutes were still increasing last year. Similarly, CENX could face similar revenue constraints as traffic grows, but customer counts level off. Nonetheless, Equinix and Telx will have to decide how seriously they want to compete in this sector. While losing out out to CENX wouldn't derail their businesses, the number of larger carriers going with the startup could soon establish CENX as the clear leader in Ethernet Exchanges.

Ethernet exchanges have rapidly become the flavor-of-the-month in telecom services. Just about every provider offering some kind of data center interconnection, business Ethernet, or corporate VoIP service has announced they are offering an Ethernet Exchange platform, or has built a connection to one. A remarkably quick development for a service that didn't really launch until late last year.

Turning Ethernet into Frame Relay

While Ethernet Exchange services are fairly new, the interconnection technology that supports them has been under development for about five years. The need for Ethernet Exchanges arose out of carrier frustration with the nonstandard connection guidelines for handing off Ethernet traffic to other service providers. This problem kept growing as many Ethernet customers were using the technology as a private data service to connect buildings, not as an Internet access service as 2001-era Ethernet providers like Yipes and Telseon were advocating.

As businesses started using Ethernet to connect locations beyond metro areas, their traffic had to be sent through multiple carrier networks, which created all kind of custom configuration requests, in addition to QoS and management issues. Essentially, Ethernet had become a shared network private data service like Frame Relay, except without an NNI (Network-to-Network-Interface) reference to make carrier handoffs simple to configure and reliable to operate.

The MEF (Metro Ethernet Forum) took up this issue around 2005, and got to work on an NNI standard to allow carriers to hand over Ethernet traffic like they had been doing for years with Frame Relay/ATM traffic. The President of the MEF, Nan Chen, also saw this as a business opportunity, and started CENX, or Carrier Ethernet Network Exchange, which launched about a year ago. The benefit of this service is to eliminate the requirement that carriers connect to each other at multiple points throughout their networks, and instead just build a single link (or a handful of links) to the exchange.

CENX vs. Equinix vs. Telx/Neutral Tandem

At the same time that CENX launched, Equinix (EQIX) developed a competing service based on the new MEF NNI specification. Equinix already had all the major service providers sitting in its IBX centers, a big advantage for establishing this kind of service. Another co-lo provider, Telx, entered the market in June, through a partnership with Neutral Tandem (TNDM) which already provided a third-party interconnection service for cell phone carriers and VoIP carriers who needed to interconnect voice traffic with long distance networks. Neutral Tandem co-founder Ron Gavillet is also the co-founder of CENX.

Competitively, the data center co-lo providers are now fighting a startup, one that has been very successful with large carriers, announcing last week that Cox Business would be coming into its exchange, in addition to Verizon (VZ), Level 3 (LVLT), and China Telecom who are already there. Equinix also has Level 3 as a customer in addition to AboveNet (ABVT), all three of whom are components of our DataCenterStocks.com Services Index.

CENX makes the claim that it's completely neutral, and does not compete with its carrier customers for corporate accounts like Equinix and Telx do. While this might be technically true, competing with customers has never held back Verizon Wholesale or the wholesale telecom market in general. Carriers have long given business to their competitors in order to provide greater network reach for their other customers. Additionally, Nan Chen is also still President of the MEF, which represents both carriers and vendors, so there are conflicts on all sides - never a surprise in wholesale telecom. A greater advantage for CENX than its claim to be conflict-free is focus, which has been the key to success for most data center service providers. Digital Realty (DLR), Equinix, Rackspace (RAX), and Akamai (AKAM) have the highest market caps in this sector, and also the narrowest product lines - they don't mix co-lo with managed services, or CDNs with bandwidth sales.

Interconnection Margins Are Typically Higher than Bandwidth Margins

CENX has an odd "let's keep things quiet" strategy that extends to who has actually financed them. That said, margins on interconnection services are typically higher than traditional bandwidth services because there is no need to spend capital on laterals to office buildings, and sales costs are reasonably low because there is no need to reach out and get a message out to small or mid-size business. Additionally, sales cycles are often shorter than they are for long-term bandwidth or IRU contracts. Neutral Tandem's financials reflect this, with net margins around 20%, gross margins in the high 60s, and a Revenue/PP&E ratio over 3 - all much higher than those of its carrier customers.

Wall Street fell out of love with Neutral Tandem when revenue flattened at around $45 million a quarter, which occurred even when VoIP and cell phone minutes were still increasing last year. Similarly, CENX could face similar revenue constraints as traffic grows, but customer counts level off. Nonetheless, Equinix and Telx will have to decide how seriously they want to compete in this sector. While losing out out to CENX wouldn't derail their businesses, the number of larger carriers going with the startup could soon establish CENX as the clear leader in Ethernet Exchanges.

Labels:

DataCenterStocks.com Services Index,

EQIX,

Ethernet Exchanges,

RAX,

TELX

Monday, September 27, 2010

Rackspace, Equinix, Akamai, Savvis, Limelight All Near 52-Week Highs

Data center stocks have had a very strong quarter, with Rackspace (RAX), Equinix (EQIX), Akamai (AKAM), Limelight (LLNW), and Savvis (SVVS) all near 52-week highs. The REITs, however, have not shared in many of the recent gains, in spite of CoreSite's IPO last week. Digital Realty (DLR) is up just 1.4% over the last three months, while DuPont Fabros (DFT) has been essentially flat since the third quarter began.

Is this all justified? Rackspace is now trading at roughly 45x annualized earnings, on a top line growth rate in the low 20s, and a bottom line growth rate of 60% over the last 12 months. Equinix is just under 4x revenue on a 21% top line growth rate (excluding Switch & Data), and the company is barely breaking even. Savvis is up 37% over the last three months and hasn't had any top line growth over the last 12 months. While the industry's fundamentals remain very strong, there's not enough growth to support a 5x multiple on revenue.

Is this all justified? Rackspace is now trading at roughly 45x annualized earnings, on a top line growth rate in the low 20s, and a bottom line growth rate of 60% over the last 12 months. Equinix is just under 4x revenue on a 21% top line growth rate (excluding Switch & Data), and the company is barely breaking even. Savvis is up 37% over the last three months and hasn't had any top line growth over the last 12 months. While the industry's fundamentals remain very strong, there's not enough growth to support a 5x multiple on revenue.

Thursday, August 5, 2010

Internap Needs to Figure Out What Business It's In

Internap (INAP) reported yesterday that quarterly revenues had declined 6% year-over-year to $61 million. The drop was expected as the company is trying to transform itself from a reseller of other provider's assets to a facilities-based data center provider. As part of that initiative, it has committed to a $50 million capital program.

Financially, Internap looks like the anti-Level 3 (LVLT). It shares Level 3's broad product line, but historically it has taken a hit on its income statement for reselling services at low margins, while Level 3 has taken a hit on its balance sheet by building large networks. Internap has much lower debt/revenue and much higher revenue/PP&E than Level 3 as a result. But now Level 3 is cutting capex to shore up its balance sheet, while Internap is increasing capex to improve its income statement.

Internap has never been a typical reseller. It developed a proprietary algorithm for routing traffic across multiple networks, but then extended the marketing concept behind this strategy to become a reseller of a broad range of IP and hosting services. Not unlike most resellers, it has a fairly broad product catalog. But transforming itself to more of a facilities-based provider means more than building up the capital budget, because it will not get a reasonable return on assets as without growing market share substantially.

Offering IP services, colocation, managed hosting, and CDNs. Internap is like Level 3, Equinix (EQIX), Rackspace (RAX), and Akamai (AKAM) rolled into one company, but without the market leadership in any of these services. To date, this has made it a balance sheet strong, but income statement weak distributor of other company's assets. But as it now builds on its own, it has to do more than commit capital to data centers, it has to look at where it can develop some kind of cost advantage over its competitors, and that won't happen in all four services.

Unlike its larger competitors, Internap owns proprietary routing software - MIRO (Managed Internet Route Optimizer) - that tackles many of the latency problems associated with BGP. But there is no reason to limit this technology to just its own service. If makes more sense economically to spread MIRO's development costs to other companies by selling it to them directly, not as part of a monthly IP service where the market has demonstrated it will not pay much premium for a proprietary technology.

In the collocation market, Internap has long relied on locating at existing facilities built by companies like Equinix and Switch and Data (which is now part of Equinix). But as long as its selling IP services, it will never truly be carrier neutral, which has been a key selling point for Equinix's service. Moreover, a $50 million boost in capital investment is not going to be enough to match the billions Equinix and Telx have already invested. It will likely have to compete on price, which is unpleasant if you are reselling, but deadly if you're selling access to your own assets.

Instead of competing against Akamai, Equinix, and Rackspace, Internap really should be competing against someone like privately-held Packet Design, which is selling its proprietary routing software to large carriers and enterprises alike. Routing is still an expensive, high latency, but necessary long distance network function, and Packet Design has had success solving corporate customers pain points with Cisco's proprietary EIGRP, and carriers' challenges with BGP. I know Internap is not about to shut down its network and just start selling its software, but there is a unique technology sitting within the company that is being stifled by the requirement that no one else can have access to it.

Financially, Internap looks like the anti-Level 3 (LVLT). It shares Level 3's broad product line, but historically it has taken a hit on its income statement for reselling services at low margins, while Level 3 has taken a hit on its balance sheet by building large networks. Internap has much lower debt/revenue and much higher revenue/PP&E than Level 3 as a result. But now Level 3 is cutting capex to shore up its balance sheet, while Internap is increasing capex to improve its income statement.

Internap has never been a typical reseller. It developed a proprietary algorithm for routing traffic across multiple networks, but then extended the marketing concept behind this strategy to become a reseller of a broad range of IP and hosting services. Not unlike most resellers, it has a fairly broad product catalog. But transforming itself to more of a facilities-based provider means more than building up the capital budget, because it will not get a reasonable return on assets as without growing market share substantially.

Offering IP services, colocation, managed hosting, and CDNs. Internap is like Level 3, Equinix (EQIX), Rackspace (RAX), and Akamai (AKAM) rolled into one company, but without the market leadership in any of these services. To date, this has made it a balance sheet strong, but income statement weak distributor of other company's assets. But as it now builds on its own, it has to do more than commit capital to data centers, it has to look at where it can develop some kind of cost advantage over its competitors, and that won't happen in all four services.

Unlike its larger competitors, Internap owns proprietary routing software - MIRO (Managed Internet Route Optimizer) - that tackles many of the latency problems associated with BGP. But there is no reason to limit this technology to just its own service. If makes more sense economically to spread MIRO's development costs to other companies by selling it to them directly, not as part of a monthly IP service where the market has demonstrated it will not pay much premium for a proprietary technology.

In the collocation market, Internap has long relied on locating at existing facilities built by companies like Equinix and Switch and Data (which is now part of Equinix). But as long as its selling IP services, it will never truly be carrier neutral, which has been a key selling point for Equinix's service. Moreover, a $50 million boost in capital investment is not going to be enough to match the billions Equinix and Telx have already invested. It will likely have to compete on price, which is unpleasant if you are reselling, but deadly if you're selling access to your own assets.

Instead of competing against Akamai, Equinix, and Rackspace, Internap really should be competing against someone like privately-held Packet Design, which is selling its proprietary routing software to large carriers and enterprises alike. Routing is still an expensive, high latency, but necessary long distance network function, and Packet Design has had success solving corporate customers pain points with Cisco's proprietary EIGRP, and carriers' challenges with BGP. I know Internap is not about to shut down its network and just start selling its software, but there is a unique technology sitting within the company that is being stifled by the requirement that no one else can have access to it.

Wednesday, July 14, 2010

How Rackspace Saved the Managed Hosting Industry

by David Gross

Since the USinternetworking bankruptcy in 2001, there has been a lot of skepticism about the managed hosting business. It squeezes in between the more asset heavy collocation industry, and the more people heavy Software-as-a-Service industry. This requires that managed hosters walk a financial tightrope between wrecking the balance sheet with too many fixed asset purchases, or destroying the income statement by hiring too many people.

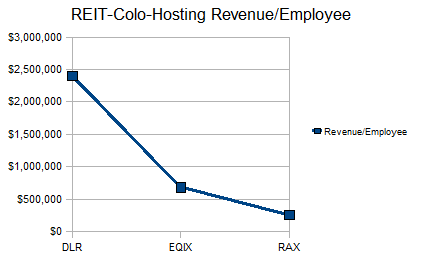

Before the USinternetworking story ended at chapter 11, there were clear warning signs of trouble with the company that were evident in its asset utilization and employee productivity ratios. It had a .48 Revenue/PP&E ratio, and just $95,000 of revenue per employee. Essentially, it was trying to be capital-intensive and labor-intensive at the same time. In addition to the dot com bust, this sent everyone scrambling away from the managed services market, and left it as a side service for collocation providers and telecom carriers, except for one company that decided to focus on it - Rackspace (RAX).

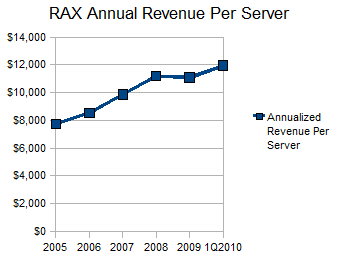

Rackspace has carefully managed both its asset utilization and employee productivity to the point that its EBITDA margins now top 30%, which is remarkable considering how this type of service was once seen as a one-way ticket to bankruptcy court. The company's 1.59 Revenue/PP&E ratio is among the highest outside of the REITs and co-lo providers. Moreover, its revenue per server has been increasing from $7,700 to 2005 to nearly $12,000 today.

The most important thing the company has done to achieve its high asset utilization has been to stay out of the unmanaged collocation business. Specifically, this has produced three major benefits:

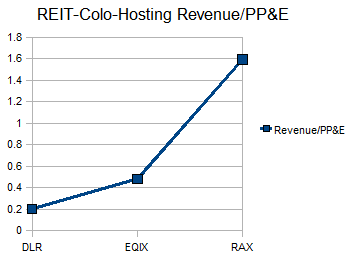

The financial benefits of sticking to managed services for Rackspace have been similar to the financial benefits Equinix (EQIX) has seen from sticking to unmanaged services, and that Digital Realty (DLR) has seen from being a simple REIT. This is best seen in each company's asset and employee utilization ratios, which are vastly different for each.

As you can see, the asset and employee utilization numbers for each company differ significantly, which is why these services do not mix well under one corporate entity. Rackspace's cloud service has not resulted in over-diversification for the company, because it runs at similar revenue/employee and revenue/asset ratios to the traditional hosting service, and it allows the company to use idle capacity in existing servers.

In addition to stronger balance sheet and income statement ratios, these focused providers have also seen higher revenue growth over the last year, as other competitors sort out which services they do and do not want to offer. Nonetheless, it does not take deep technical knowledge to succeed in this business, just a simple understanding of how to choose between spending on people or spending on assets.

Since the USinternetworking bankruptcy in 2001, there has been a lot of skepticism about the managed hosting business. It squeezes in between the more asset heavy collocation industry, and the more people heavy Software-as-a-Service industry. This requires that managed hosters walk a financial tightrope between wrecking the balance sheet with too many fixed asset purchases, or destroying the income statement by hiring too many people.

Before the USinternetworking story ended at chapter 11, there were clear warning signs of trouble with the company that were evident in its asset utilization and employee productivity ratios. It had a .48 Revenue/PP&E ratio, and just $95,000 of revenue per employee. Essentially, it was trying to be capital-intensive and labor-intensive at the same time. In addition to the dot com bust, this sent everyone scrambling away from the managed services market, and left it as a side service for collocation providers and telecom carriers, except for one company that decided to focus on it - Rackspace (RAX).

Rackspace has carefully managed both its asset utilization and employee productivity to the point that its EBITDA margins now top 30%, which is remarkable considering how this type of service was once seen as a one-way ticket to bankruptcy court. The company's 1.59 Revenue/PP&E ratio is among the highest outside of the REITs and co-lo providers. Moreover, its revenue per server has been increasing from $7,700 to 2005 to nearly $12,000 today.

The most important thing the company has done to achieve its high asset utilization has been to stay out of the unmanaged collocation business. Specifically, this has produced three major benefits:

- The company has not been forced to build data centers near its customers, it's left the mad scramble for space in Northern New Jersey to the collocation providers, who have to be there for their financial customers

- It has had the resources to expand into cloud hosting, which offers growth opportunities, but significant financial risk for the provider that must both staff up and construct new facilities at the same time

- It has achieved better volume discounts from suppliers, by saving 2/3rds of its capital budget for customer servers and equipment, not new buildings

The financial benefits of sticking to managed services for Rackspace have been similar to the financial benefits Equinix (EQIX) has seen from sticking to unmanaged services, and that Digital Realty (DLR) has seen from being a simple REIT. This is best seen in each company's asset and employee utilization ratios, which are vastly different for each.

As you can see, the asset and employee utilization numbers for each company differ significantly, which is why these services do not mix well under one corporate entity. Rackspace's cloud service has not resulted in over-diversification for the company, because it runs at similar revenue/employee and revenue/asset ratios to the traditional hosting service, and it allows the company to use idle capacity in existing servers.

In addition to stronger balance sheet and income statement ratios, these focused providers have also seen higher revenue growth over the last year, as other competitors sort out which services they do and do not want to offer. Nonetheless, it does not take deep technical knowledge to succeed in this business, just a simple understanding of how to choose between spending on people or spending on assets.

Labels:

Managed Hosting,

RAX

Friday, July 9, 2010

Fibre Channel over Ethernet - Reducing Complexity or Adding Cost?

by David Gross

Data center servers typically have two or three network cards. Each of these adapters attaches to a different network element—one which supports storage over Fibre Channel, a second for Ethernet networking, and a third card for clustering, which typically runs over InfiniBand. At first glance, this mix of networks looks messy and duplicative, and has led to calls for a single platform that can address all of these applications on one adapter.

Five years ago, when the trend was "IP on everything", iSCSI was seen as the one protocol that could pull everything together. Today, with the trend being "Everything over Ethernet", Fibre Channel over Ethernet, or FCoE, is now hailed as the way to put multiple applications on one network. However, there is still growing momentum behind stand-alone InfiniBand and Ethernet, with little indication that the market is about to turn to a single grand network that does everything.

Stand-Alone Networks Still Growing

In spite of all the theoretical benefits of a single, "converged" network, InfiniBand, which is still thought by many to be an odd, outlier of a protocol, continues to grow within its niche. According to Top 500.org, the number of InfiniBand-connected CPU cores in large supercomputers grew 70% percent from June 2009 to June 2010, from 1.08 million to 1.8 million. QLogic (QLGC) and Voltaire (VOLT) recently announced major InfiniBand switch deployments at the University of Edinburgh and Tokyo Institute of Technology respectively, while Mellanox (MLNX) recently publicized a Google (GOOG) initiative that's looking at InfiniBand as a low power way of expanding data center networks.

InfiniBand remains financially competitive because of its switch port costs. With 40 gigabit InfiniBand ports available for $400, there is a growing, not declining, incentive to deploy them.

In addition to low prices for single protocol switch ports, another challenge facing the "converged" network is low prices for single protocol server cards. While having multiple adapters on each server might seem wasteful, 10 Gigabit Ethernet server NICs have come down in price dramatically over the last few years, with street pricing on short-reach fiber cards dropping under $500, and prices on copper CX4 adapters falling under $400. Fibre Channel over Ethernet Converged Network Adapters, meanwhile, still cost over $1,500. The diverged network architecture, while looking terrible in vendor PowerPoints, can actually look very good in capital budgets.

Data Centers are Not Labor-Intensive

In addition to capital cost considerations, many of the operational savings from combining Local Area Networks and Storage Area Networks can be difficult to achieve, because most data centers are already running at exceptionally high productivity levels. Stand-alone data centers, like those Yahoo (YHOO) and Microsoft (MSFT) are currently building in upstate New York and Iowa, cost nearly $1,000 per square foot to construct - more than a Manhattan office tower. Additionally, they employ about one operations worker for every 2,000 square feet of space, ten times less than a traditional office where each worker has about 200 square feet. This also means the data center owners are spending about $2 million in capital for every person employed at the facility.

Among publicly traded hosting providers, many are reporting significant revenue growth without having to staff up significantly. Rackspace (RAX), for example, saw revenue increase by 18% in 2009, when it reported $629 million in sales. But it only increased its work force of “Rackers”, as the company calls its employees, by 6%. At the same time, capex remained very high at $185 million, or a lofty 29% of revenue. In the data center, labor costs are being dramatically overshadowed by capital outlays, making the potential operational savings of LAN/SAN integration a nice benefit, but not as pressing a financial requirement as improving IRRs on capital investments.

FCoE does not look like a complete bust, there are likely to be areas where it makes sense because of its flexibility, such as servers on the edge of the SAN. A lot of work has gone into making sure FCoE fits in well with existing networks, but much more effort is needed to make sure it fits in well with capital budgets.

Chief Technology Analyst Lisa Huff contributed to this article

Data center servers typically have two or three network cards. Each of these adapters attaches to a different network element—one which supports storage over Fibre Channel, a second for Ethernet networking, and a third card for clustering, which typically runs over InfiniBand. At first glance, this mix of networks looks messy and duplicative, and has led to calls for a single platform that can address all of these applications on one adapter.

Five years ago, when the trend was "IP on everything", iSCSI was seen as the one protocol that could pull everything together. Today, with the trend being "Everything over Ethernet", Fibre Channel over Ethernet, or FCoE, is now hailed as the way to put multiple applications on one network. However, there is still growing momentum behind stand-alone InfiniBand and Ethernet, with little indication that the market is about to turn to a single grand network that does everything.

Stand-Alone Networks Still Growing

In spite of all the theoretical benefits of a single, "converged" network, InfiniBand, which is still thought by many to be an odd, outlier of a protocol, continues to grow within its niche. According to Top 500.org, the number of InfiniBand-connected CPU cores in large supercomputers grew 70% percent from June 2009 to June 2010, from 1.08 million to 1.8 million. QLogic (QLGC) and Voltaire (VOLT) recently announced major InfiniBand switch deployments at the University of Edinburgh and Tokyo Institute of Technology respectively, while Mellanox (MLNX) recently publicized a Google (GOOG) initiative that's looking at InfiniBand as a low power way of expanding data center networks.

InfiniBand remains financially competitive because of its switch port costs. With 40 gigabit InfiniBand ports available for $400, there is a growing, not declining, incentive to deploy them.

In addition to low prices for single protocol switch ports, another challenge facing the "converged" network is low prices for single protocol server cards. While having multiple adapters on each server might seem wasteful, 10 Gigabit Ethernet server NICs have come down in price dramatically over the last few years, with street pricing on short-reach fiber cards dropping under $500, and prices on copper CX4 adapters falling under $400. Fibre Channel over Ethernet Converged Network Adapters, meanwhile, still cost over $1,500. The diverged network architecture, while looking terrible in vendor PowerPoints, can actually look very good in capital budgets.

Data Centers are Not Labor-Intensive

In addition to capital cost considerations, many of the operational savings from combining Local Area Networks and Storage Area Networks can be difficult to achieve, because most data centers are already running at exceptionally high productivity levels. Stand-alone data centers, like those Yahoo (YHOO) and Microsoft (MSFT) are currently building in upstate New York and Iowa, cost nearly $1,000 per square foot to construct - more than a Manhattan office tower. Additionally, they employ about one operations worker for every 2,000 square feet of space, ten times less than a traditional office where each worker has about 200 square feet. This also means the data center owners are spending about $2 million in capital for every person employed at the facility.

Among publicly traded hosting providers, many are reporting significant revenue growth without having to staff up significantly. Rackspace (RAX), for example, saw revenue increase by 18% in 2009, when it reported $629 million in sales. But it only increased its work force of “Rackers”, as the company calls its employees, by 6%. At the same time, capex remained very high at $185 million, or a lofty 29% of revenue. In the data center, labor costs are being dramatically overshadowed by capital outlays, making the potential operational savings of LAN/SAN integration a nice benefit, but not as pressing a financial requirement as improving IRRs on capital investments.

FCoE does not look like a complete bust, there are likely to be areas where it makes sense because of its flexibility, such as servers on the edge of the SAN. A lot of work has gone into making sure FCoE fits in well with existing networks, but much more effort is needed to make sure it fits in well with capital budgets.

Chief Technology Analyst Lisa Huff contributed to this article

Labels:

Fibre Channel over Ethernet,

InfiniBand,

Microsoft,

RAX,

Yahoo

Tuesday, June 29, 2010

Data Center Providers Hit Particularly Hard in Selloff

NASDAQ was down 3.85% today, but data center providers did even worse. Some of the big decliners today included:

One company bucking today's trend was CDN provider Limelight Networks (LLNW), which finished up 3 cents.

- Equinix (EQIX) down 4.66%

- Savvis (SVVS) down 5.33%

- Rackspace (RAX) down 5.33%

- Internap (INAP) down 8.97%

- Akamai (AKAM) down 8.59%

- Terramark (TRMK) down 5.99%

One company bucking today's trend was CDN provider Limelight Networks (LLNW), which finished up 3 cents.

Subscribe to:

Posts (Atom)